By Dhananath Fernando

Originally appeared on The Morning

We all have New Year’s resolutions. Most of the time, they are not new at all. They are the things we always wanted to do, but never made time for, or never had the courage to start. So every year we repeat the same promise in different words, hoping that this time will be different.

Sri Lanka is not very different in 2026. As a country, we also have resolutions. They are familiar, inspiring, and regularly repeated. Yet they remain largely unfinished.

In many cases, we did not fail because we lacked effort. We failed because we misunderstood the problem. We kept chasing outcomes without fixing the process.

For years, our national resolution list has looked more or less like this:

A trading hub in the Indian Ocean

Export diversification

A tourism paradise

All three are still worth keeping for 2026. But if we want them to be more than slogans, we have to turn them into a reform checklist and not just a speech.

Trading hub is not about ships

Becoming a trading hub is not primarily about the ocean, shipping containers, or building warehouses near the port. It is about building a policy environment that attracts competent people and serious capital, and allows them to move goods quickly, add value, and serve markets.

Trading hubs do not manufacture everything they consume. That is not the point. A trading hub brings things from all over the world, stores them, processes or packages them, trades them, adds value, and sends them back to where demand is. It is an ecosystem, not a factory.

That ecosystem depends on speed, predictability, and cost.

In Sri Lanka, the cost of trading is high not only because of distance but because of policy. Para-tariffs and complex border taxes raise input prices. Slow and discretionary Customs processes delay shipments. Barriers to entry in logistics and shipping reduce competition. Labour rules and immigration processes make it difficult to attract global talent or even short-term specialists.

If 2026 is serious about the trading hub dream, then the resolution is not to ‘become a hub.’ The resolution is to do the hard and unglamorous work: modernise the Customs Ordinance, simplify border procedures, reduce para-tariffs, and remove barriers for entry and ownership in shipping and related services.

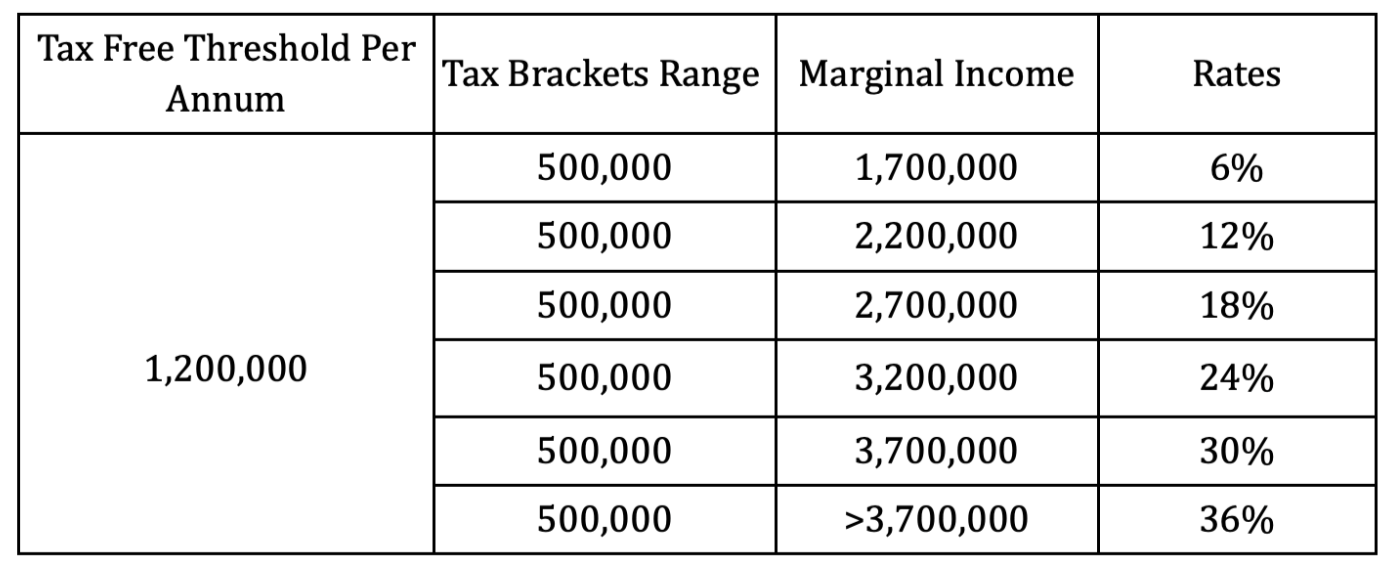

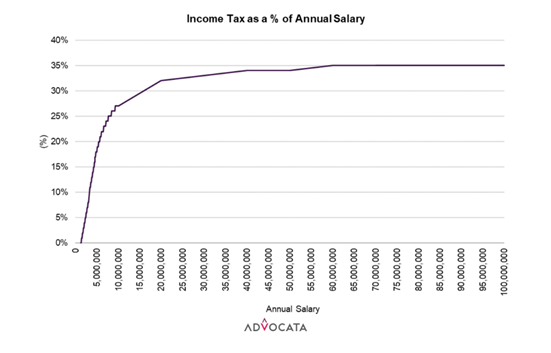

We should also reform labour and entry processes so skilled foreigners can work here easily, contribute, and move on if needed. Trading happens when trading becomes easier and cheaper than in competing countries.

A hub is not declared. It is designed.

Export diversification cannot happen on speeches

Export diversification has been discussed for so long that it has become a classroom lesson. Yet our export basket remains narrow and our transformation has been slow.

The reasons are not mysterious. They are structural.

Export diversification depends on factor markets working well: land, labour, and capital.

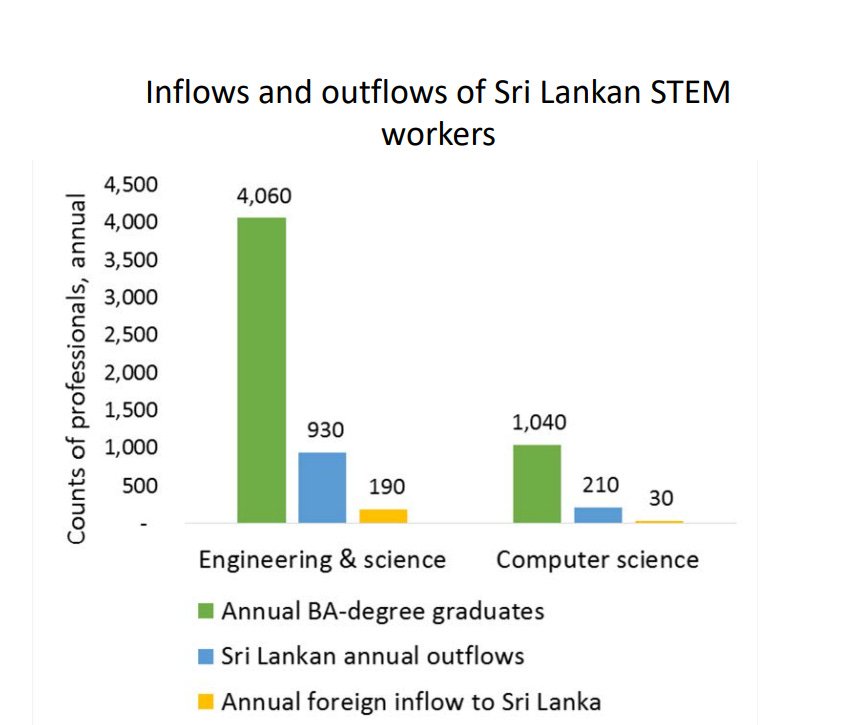

In Sri Lanka, land is difficult to use productively because ownership, access, and clear titles are complicated. Labour shortages are real, but the deeper problem is skills. A modern export economy requires technicians, designers, engineers, supervisors, and managers, not only workers. Capital is also a constraint, and capital for new industries often needs to come from outside through foreign direct investment.

But investors do not move money just because a country ‘needs dollars.’ They look for a level playing field, regulatory predictability, and access to markets. They also look for reliable infrastructure and a stable macro environment.

So if 2026 wants export diversification, the resolution cannot be another line in a policy document. It has to be a shift in how we attract and support investment.

The Board of Investment must be strengthened and reoriented towards active investor facilitation, not paperwork. Industrial zones should be opened to professional private sector operation and management. The country must actively pursue market access and trade facilitation, because new industries will not come if they cannot sell competitively.

Diversification is not a solo act. It is a system working together.

Tourism paradise needs policy, not posters

Tourism is often marketed with sunsets and smiles. But higher-spending tourists do not arrive because we printed better brochures. They arrive because the product is better and the experience is seamless.

If Sri Lanka wants to be a tourism paradise in reality, then the policy environment must help the sector upgrade.

Hotels should be able to renovate and expand without construction costs being inflated by tariffs and restricted access to quality materials and modern designs. We cannot talk about high-value tourism while making it expensive to build high-quality tourism infrastructure.

Airports and connectivity matter too. Capacity constraints and slow expansion weaken the entire tourism plan. And aviation needs competition, not protection. Monopolies and market distortions in aviation may keep certain entities alive, but they keep the country small.

Tourist destinations also need better services. That means managing and leasing services properly, creating space for private investment, improving safety and cleanliness, and creating real spending opportunities beyond hotel walls. A tourist cannot spend money if there is nothing to do, nowhere to shop, and no quality experience to buy.

A tourism paradise is built on policy decisions, not on slogans.

The resolution underneath all resolutions

There is one resolution that sits underneath all the others: monetary stability.

None of the above dreams work if inflation rises, the exchange rate becomes unpredictable, and confidence collapses. Businesses do not plan long-term investments when the value of money itself is uncertain. Tourists do not come in large numbers when macroeconomic instability turns into shortages, controls, and political tension. Exporters cannot build stable supply chains when the policy environment swings with every crisis.

In that sense, the country’s New Year’s resolution is not only about what we want to become, but about what we must protect: low inflation, a sound currency, credible fiscal management, and rule-based policy.

New Year’s resolutions, whether personal or national, are more about process than promises. Outputs come when the process is followed. Pronouncing the outcome without committing to the steps is how we fail every year, as individuals and as a country.

So perhaps Sri Lanka’s economic resolution for 2026 should be simple: stop repeating the dream and start doing the list.