Originally appeared on the Daily FT, Daily Mirror

By Daniel Alphonsus

Visa reform will boost tourism and reverse brain drain

Three million tourists are set to visit our shores next year. We will issue nearly as many online visas - millions too many. ETAs are a tourist's bane: rather than dreamy sun, sea and sand, the weary salaryman’s getaway begins with the tedium of forms.

The tourist’s ayubowan to Sri Lanka begins with ferreting for flight details and credit cards. Warm-up complete, the ordeal begins in earnest: 20 clicks to navigate through the ETA form and countless key strokes to fill out the 27 form fields. Each question brings forth its own miseries, and sometimes mind-reading feats: “They’re asking me for my address in Sri Lanka. Hmm, does this mean my first address, my last address…but I haven’t even booked my hotel..dear, dear maybe I should book the Maldives instead. They’ve got a visa-on-arrival.” Followed, naturally, by web-pages reloading with unsaved data and vindictive payment gateways rejecting credit cards for arcane and esoteric reasons. Rather than a Small Miracle, they experience So Sri Lanka.

This charade costs us millions of dollars every year. We are losing tens of thousands of tourists to our competitors.

Based on the three scenarios below, switching from ETA to visa-on-arrival à la the Maldives or Singapore should generate between $24 million to $145 million in additional tourism revenue.

The precise number is not especially relevant. The point is that these roughly right numbers are substantial enough to generate a robust prima facie case for experimenting with opening up visa-on-arrival and optimising the ETA experience

For workings click here.

Visas-on-arrival

Sri Lanka already operates visa-on-arrival for Singapore, Maldives and Seychelles citizens. In light of the tens of millions of dollars we’re losing in the absence of visas-on-arrival, very compelling reasons must be provided for not opening-up visa-on-arrival for citizens of our main tourism markets (such as the EU, China, Russia and UK). Plus those who have passed extensive checks in the process of traveling to other countries. For example, travelers holding multiple entry visas to the US can visit about 51 countries visa free.

The burden of proof is therefore on those who say we ought not have a visa-on-arrival regime. All the more so because it appears that, even though not advertised, in a pinch, obtaining a visa-on-arrival is possible at BIA. Also note that airlines share passenger records with governments 24 hours before arrival. It takes seconds for our border agencies to check the relevant blacklists as they already have API integrations in place. The response time of an Interpol database query is half a second.

In addition, immigration department annual reports show that almost all rejections and deportations are from a handful of countries, mainly India. Other than a German and an Australian, no UK, EU, ASEAN or Australian national was rejected or deported in 2022. This suggests a risk-based, optimized approach is very much possible, and prudent.

Many of us have experienced this personally. We are more likely to tour Singapore because Sri Lankans enjoy visa-on-arrival. In fact, on average it only takes us 10 minsto enter Singapore. As shown in the picture above, for passport holders of 50+ countries, the experience is even more smooth. Using automated immigration gates, they clear border control in less than two minutes.

Optimize the ETA process

Some tourists may still prefer to secure an ETA before arrival. Therefore, we should do our best to ensure the application is seamless. Currently it is not. Of the 27 fields requested on the ETA, about 20 can be found in passenger record details airlines share with immigration authorities. They are redundant. Questions on the ETA should be limited to around seven fields. The amount of information gathered should be commensurate with the risk: those from high risk countries could be subject to additional questions.

Eliminate the ETA fee

Credit card payments are often an even greater source of friction. Tourists need to pay $20 via credit card for an ETA. This deters potential tourists; it's another step in the journey and credit card payments often fail. So much so, the our embassy in Germany issued the following notice:

“On Arrival Visa at the Port of Entry to Sri Lanka: submit visa application and payment at Colombo International Airport. A fee of USD 60 will be charged for this service. Please observe that this option of obtaining a visa is available only for German passport holders, who have tried to obtain a visa via the ETA-system www.eta.gov.lk, but failed due to not being able to pay the fees with credit card.”

It's not only card friction that is the problem. Many Chinese citizens no longer own cards and use Alipay instead.

Wiser countries like Singapore understand that reducing friction encourages more tourists to arrive, and thereby spend more. Which is why they don’t charge tourists a fee.

*Note the ETA fee is $20 for SAARC and $50 for other nationalities. $40 is a rough weighted average. For workings click here.

Based on the rough estimates above, if the ETA fee or friction puts off even three percent of tourists, then Sri Lanka stands to unequivocally benefit from eliminating the ETA fee. The exchequer will be worse off for now. But the Treasury still recoups some of the lost visa fees by higher VAT revenue directly, and indirectly via higher income tax from tourism sector firms and employees. (1)

Brain Gain

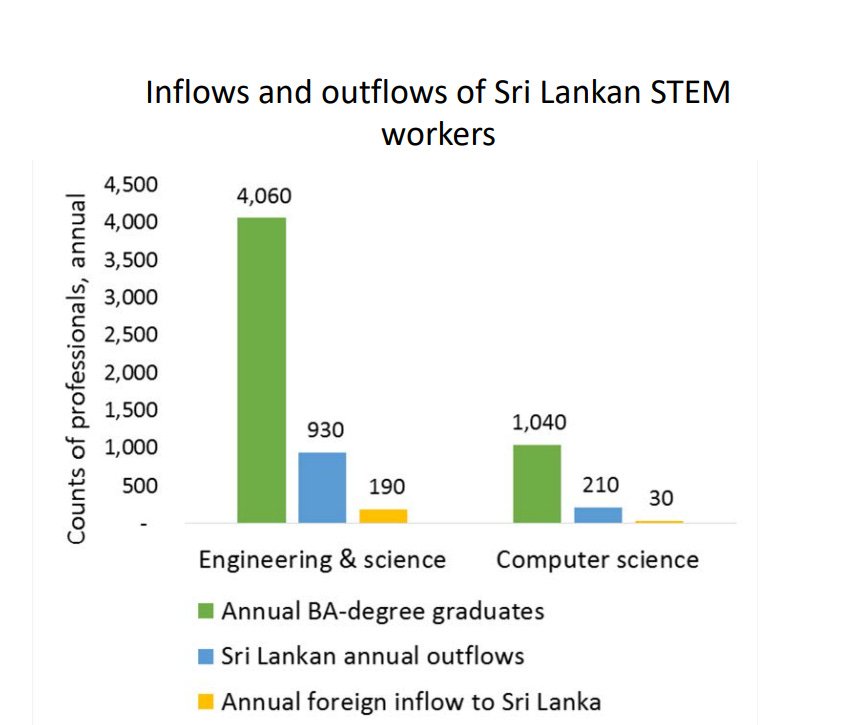

Since Independence Sri Lanka has lost or chased away lakhs of skilled workers. Many middle class families can proudly count at least one doctor, accountant and engineer (among many other species of the middle bourgeoisie) among their relations overseas. Between 2005 and 2015, the BOI estimated that around 20% of STEM graduates left the country every year. With COVID and the economic crisis, emigration was particularly acute the last few years. But it's not new. Skilled emigration is a chronic problem we’ve faced for decades.

(2 ) This report offers a rigorous treatment of the topic from the 1970s.

We desperately need to reverse brain drain. Of course, the central challenge is building a Sri Lanka in which Sri Lankans want to stay. But that is beyond the scope of this article. Here we shall only discuss how we can make it easier for skilled talents to come, and contribute.

Some readers may be perplexed that even a handful of skilled non-Sri Lankans want to live and work on our island. But we live in a nomadic, connected and occasionally romantic age. These rare souls exist.

We must do everything in our power to welcome and encourage them. Above all, by simply removing barriers to them legally working here. For the path to prosperity is paved by productivity growth. Therefore, it makes absolutely no sense for us to create barriers for skilled migration. It is the opposite of what smart countries do - especially via human capital theft aka points-based migration. There are three main ways foreign talent raises Sri Lanka’s productivity, growth and thereby prosperity. Foreign talent:

Adds human capital: whenever someone who has higher productivity than the average Sri lankan worker moves to Sri Lanka, they raise Sri Lanka’s average productivity directly. We already have huge talent shortages in key sectors like IT.

Upgrades existing human capital: foreign talent, directly or by osmosis, teaches their skills to others.

Increases existing human capital productivity: the whole is often greater than the sum of its parts. Skilled talent enables others to be more productive. For example, having access to a pediatric neurosurgeon makes all pediatricians more productive as knowledge is shared from expert to generalist. Alternatively, having a Japanese team-member makes the whole team more effective when working with Japanese clients.

Per capita GDP is a good proxy for average worker productivity. Therefore, if someone from a richer country moves to a poorer country, then the average productivity of the poorer country will improve. How do we do this? The Harvard Centre for International Development has some ideas from which I borrow liberally.

The fastest way for Sri Lanka to have brain gain to compensate for some of the brain drain is to:

Offer a two-year visa-on-arrival for those from countries that are 4x richer than Sri Lanka

Offer a two-year renewable visa-on-arrival for citizens or permanent residents of countries which have per capita incomes at least four times that of Sri Lanka. (3)

Amend the Citizenship Act such that any person who has at least two Sri Lankan grandparents is eligible for citizenship. ()4

Regularize employment of all foreign spouses of Sri Lankan nationals, including a path to permanent residency and citizenship. (5)

The first of these measures can be implemented by the stroke of the minister’s pen.(6) Sri Lanka’s immigration act provides for broad ministerial discretion. The minister is empowered to make entry regulations for visas upto five years in length. He or she can implement Point A above without requiring primary legislation.

We have little to lose, and all to gain. Try these measures for a year, try them for a few countries. Then roll-back or amend accordingly. Sri Lanka has a long history of policy-instability, but we should not confuse the many cases of foolish equivocation with genuine experimentation. That is what this budget should propose: bold measures to breakthrough our malaise and initiate the process of transitioning from stabilisation to recovery.

(1) As this article is solely on matters related to the immigration act, I’m not going to discuss this in detail. But it's worth noting that levying a flat (dis)embarkation levy is also a deterrent against short-haul traffic. Instead, the airports authority should price the levy based on the distance between Sri Lanka and the origin/destination airport.

(2) Diaspora remittances do little to compensate: Sri Lankans remit more from the Maldives than Australia.

(3) For those that ask why a per capita GDP based criterion rather than points-based criteria, my answer is simple. A points-based system inherently involves discretion, and in the context of our state (in)capacity and corruption, will result in friction (countless people will not bother applying with all the documents that will be required), many false positives (as the assessors of points, e.g. a degree certificate’s legitimacy, will be corrupt) and false negatives (because those with skills we want may not have the right paper to demonstrate it). Considering this range of incentive problems and Type I/II errors, a very conservative threshold like the 4x per capita GDP one suggested is most optimal.

(4) For further details on this point and the next point, see page 14 of this study on Sri Lanka’s immigration framework.

(5) Reaching consensus in Parliament on this point should be easy. Sajith Premadasa’s manifesto promises dual citizenship after three years of residence for foreign spouses of Sri Lankans. See page 39.

(6) Soon, one hopes, his or her digital signature. In fact, the President should announce that he will only sign documents via a digital signature from 31 December 2023 onward.

The opinions expressed are the author’s own views. They may not necessarily reflect the views of the Advocata Institute or anyone affiliated with the institute.