By Tormalli Francis

Originally appeared on the Morning

Why VAT exemptions sour the market

A Value-Added Tax (VAT)-free litre of milk or cup of yoghurt may feel like relief at the checkout, which is in fact a silent distortion of lost revenue, stifled competition, and a marketplace where not all producers compete on an equal playing field.

The Government’s VAT exemption on locally produced milk and yoghurt is presented as a move to improve child nutrition and support local dairy farmers. On the surface, it appears humane and sensible; after all, what government wouldn’t want to make nutritious food more affordable while reducing dependence on imports?

But public policy, like milk, can curdle if left unchecked.

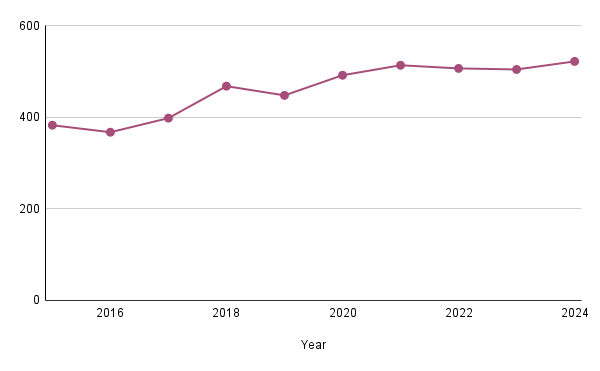

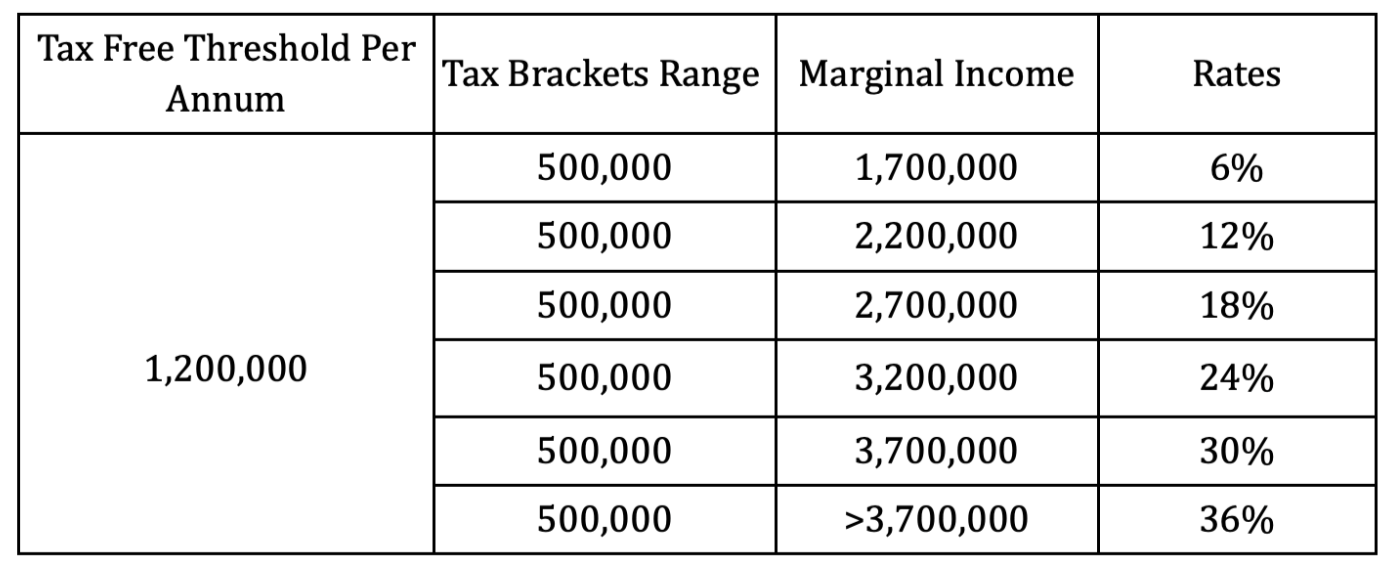

Milk production in Sri Lanka is a long-standing traditional industry that has endured for thousands of years, producing over 500 million litres of milk annually (Figure 1), with more than 130,000 farmers (Figure 2) contributing to the production of milk islandwide.

Yet this exemption, packaged with its good intentions, highlights a recurring policymaking problem in the Sri Lankan economy: sacrificing long-term efficiency for short-term optics. In reality, VAT exemptions, however well intentioned, often distort the tax system, weaken the fiscal base, and may ultimately harm both consumers and the very farmers they are meant to protect.

Equal tax, equal opportunity

In a sound tax system, neutrality is essential; similar goods should be taxed in similar ways, and the system should not favour one product or producer over another.

Exempting only locally sourced milk and yoghurt breaks this principle. It grants preferential treatment to domestic producers, while imported milk powder, which is still a staple in many urban Sri Lankan households, remains subjected to VAT. This selective exemption can hinder fair competition, discourage innovation, and misallocate resources, ultimately compromising market efficiency.

This distorts market dynamics. Producers of other dairy products such as cheese, butter, and especially curd face a cost disadvantage, not because of inefficiency but because of policy. The exemption becomes a de facto subsidy, not through open direct Government expenditure but through hidden distortion in the tax system.

A country case example of a similar situation is seen in Georgia, where VAT exemptions apply to domestically produced milk and dairy products but not to imported or reconstituted alternatives. While intended to support local farmers and consumers, this approach creates an uneven competitive environment. Producers who rely on imported inputs including those making value-added dairy products face rising costs without benefiting from the exemption.

Such policies also break the VAT chain, as inputs are subjected to VAT and outputs are exempted. This raises production costs, especially for downstream manufacturers, distorts price signals, and leads to inefficient resource allocation across the sector.

Undermining revenue for reform

In the context of Sri Lanka’s fiscal challenges and commitments to international financial institutions like the International Monetary Fund (IMF), it is important to broaden the tax base.

VAT exemptions reduce potential Government revenue, which could otherwise be allocated to essential public services or targeted welfare programmes. Maintaining a wide array of exemptions complicates tax administration and undermines efforts to achieve long-term fiscal sustainability.

When tax revenue is eroded by such sector-specific exemptions, this shifts the burden elsewhere – either to other goods or services or to Government borrowing. Sri Lanka is in a period of fiscal crisis, with IMF-backed reforms requiring revenue generation. Exemptions reduce tax income from a high-volume essential product, limiting funds for healthcare, education, or infrastructure.

Ad hoc policy changes and weak tax administration have been the major contributors towards the decline in tax revenue, which have brought in fiscal challenges. A well-developed tax system is an efficient revenue instrument, but exemptions and reduced rates erodes its performance.

Basic commodities such as milk and yoghurt are often the options for exemptions or reductions in most Low-Income Developing Countries (LIDCs). In 2020, the VAT exemptions in these countries amounted to 1.3% of GDP. Revenue loss from such policies tends to outweigh the actual gains for the vulnerable groups.

Better tools for better targets

A key justification for exemptions on milk and yoghurt is to improve nutrition and support dairy farmers by making these products more affordable for vulnerable groups and increasing farmer incomes.

The dairy industry has been identified as the priority sector for development among the other livestock sub sectors in the country for its crucial role in reducing nutritional deficiencies across all age groups, and serving as a key source of affordable, high-quality nutrition for the population.

But VAT exemptions are an imprecise way to deliver support. While they aim to make basic commodities more affordable, such blanket policies often result in an imbalance, as higher-income households benefit more than the intended low-income groups.

A greater proportion of basic commodities are consumed by the richer households with greater purchasing power as they are likely to capitalise on these tax breaks. This misalignment highlights the inefficiency of VAT exemptions as a tool for social welfare. It is, in essence, a regressive subsidy disguised in the language of progressivism.

With exemptions having a progressive impact, they are poorly targeted ways to help low-income households, showcasing that directly targeted mechanisms will be better tools to address distributional concerns.

If the goal is to improve nutrition among the most vulnerable and improve farmers’ livelihoods, Sri Lanka should focus on strengthening targeted, transparent support systems. Direct transfers to low-income households, investment in school milk programmes, input subsidies to farmers, and upgrading the dairy industry infrastructure would deliver an efficient and equitable alternative.

These measures ensure that support reaches those who need it most without distorting market signals or undermining long-term efficiency.

Not a structural solution

Sri Lanka’s VAT exemption on locally produced milk and yoghurt may feel like a compassionate move, and in some ways, it is. But ultimately, it’s a fiscal quick fix, not a structural solution. A neutral tax system with broad based rates and minimal carve-outs helps maintain fairness, supports productive specialisation, and sustains Government revenue.

If we want to nourish our economy as well as our children, we must move from tax distortion to targeted policy. Milk can be good for the bones, but only when it doesn’t weaken the backbone of the economy.

(The writer is a Research Analyst at Advocata Institute)

(The views and opinions expressed in this article are those of the author and do not necessarily reflect the official position of this publication)

Figure 1: Trend of total annual local milk production (million litres) – 2015-2024

(Source: Livestock Statistics, Department of Census and Statistics)

Figure 2: Number of dairy farmers by district – 2024

(Source: Livestock Statistics, Department of Census and Statistics)