By Dhananath Fernando

Originally appeared on the Morning

On Wednesday (16), a daily newspaper reported that the new Government was planning to strike a fuel supply deal between the Ceylon Petroleum Corporation (CPC) and the Ceylon Electricity Board (CEB) for power generation.

Following this report, there was significant discussion on social media questioning why the Government would deviate from the competitive bidding process (a few Government representatives have personally informed us over the phone that the facts in the news story are incorrect and that the Government plans to clarify details through a press conference).

If the news is true, it would mean that the CEB would no longer engage in competitive bidding when purchasing fuel from the CPC. Fuel purchases, including hydrocarbons like naphtha and heavy fuel oil, are key input costs in electricity generation.

Regardless of the news story’s accuracy, the main concern for businesses is that bypassing the competitive bidding process in fuel procurement could lead to significant risks for CPC and CEB financial stability with corruption vulnerabilities. If the CPC and CEB start incurring losses or attempt to cover up losses by increasing tariffs, it could destabilise the economy.

To put this into perspective, the CPC’s revenue for 2023 was approximately Rs. 1,300 billion and the CEB’s about Rs. 679 billion. In comparison, Sri Lanka’s total tax revenue, including Value-Added Tax (VAT) for 2023, was around Rs. 3,000 billion.

Together, these two institutions manage a cash inflow that amounts to nearly two-thirds of the country’s total tax revenue. Even a minor financial misstep could result in a major crisis for the Government, leading to a complete economic collapse.

Avoiding the competitive bidding process creates a vulnerability to corruption. Competition is a crucial tool for preventing corruption, as it automatically introduces checks and balances through price signals on the supplier side. Without competitive bidding, any corruption within the CPC or CEB would likely manifest as significant financial losses in their balance sheets. Unlike other institutions, losses at the CPC and CEB have massive spillover effects, as has been seen under successive governments.

Typically, the CPC sells naphtha – a byproduct of its refinery – at a price higher than the market rate to the CEB. This is one way the CPC tries to offset its own inefficiencies or cover losses when the Government mandates fuel sales below production cost. However, when the CPC charges more for naphtha, electricity generation becomes more expensive, prompting the CEB to seek tariff increases.

On top of this, the CEB often delays payments to the CPC when it experiences losses, which forces the latter to borrow money from banks at high interest rates. These costs, in turn, are passed on to consumers, affecting industries across the board – from rice mills to poultry farms and even hotel operations, as energy costs are a major expense (CEB tariff hikes impact the water bill and many other industries, including through increasing inflation).

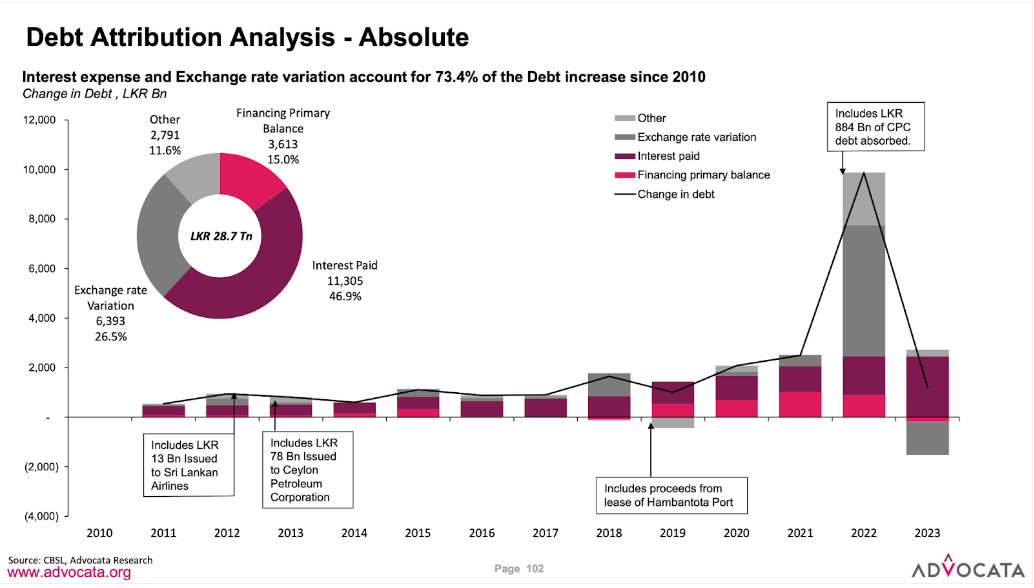

The CPC also sells jet fuel to SriLankan Airlines at inflated prices, similar to how it overcharges the CEB for naphtha. Jet fuel is a significant cost for the aviation industry and the high prices can push airlines into losses. When the CPC, CEB, and SriLankan Airlines all incur losses, they ultimately turn to the Treasury for bailouts.

It is no secret that the Treasury’s budget deficit has remained massive for years, compared to the country’s GDP. Consequently, the Government then turns to State-owned banks like the Bank of Ceylon (BOC) and People’s Bank (PB) to cover the losses. In many cases, the Government provides Treasury guarantees, sometimes even in US Dollars, for fuel purchases.

These banks, in turn, are forced to lend depositors’ money to these institutions, often at a high risk due to the prime lending rates. Ultimately, the financial mismanagement of the CPC and CEB trickles down to depositors’ hard-earned savings.

In the last Budget, the Government allocated Rs. 450 billion, equivalent to three years of Advance Personal Income Tax (APIT, previously the Pay-As-You-Earn [PAYE] tax), to recapitalise the banking sector, mainly with State banks. In addition, the Government absorbed $ 510 million into the Treasury to address losses at SriLankan Airlines, largely caused by the CPC’s inflated prices.

If the CPC indeed moves away from competitive bidding, it is a clear signal of poor governance and a warning of future economic hardship, potentially affecting depositors’ savings. When the CPC and CEB incur losses, the Government typically has to either increase the prices of electricity and fuel beyond what is set by price formulas or continue providing subsidies – both of which lead to higher taxes or interference with key economic indicators, thus creating political pressure.

This cycle has been ongoing for years, which is why the business community and others are deeply concerned about the CPC leaving the competitive bidding process. If the news is false, we can be relieved. But it is essential to understand the grave risks of abandoning competitive bidding, as it extends far beyond corruption; it threatens to bring about complete financial instability.