By Dhananath Fernando

Originally appeared on the Morning

The past week’s talk has been about curtailing housing facilities and other perks for former presidents. Many Sri Lankans are rightly interested in where former leaders live. But here is the real question: why are millions of ordinary Sri Lankans struggling to build their own homes?

Housing is a basic human need. Yet in Sri Lanka, it is not only the poor but even the middle class who fight an uphill battle.

Look around any neighborhood: countless homes remain unfinished. The ground floor is barely complete, steel rods jut out of columns waiting for a first floor that never comes. Walls stand unplastered, kitchens are bare, and curtains are unaffordable. For many families, building a house is a lifelong project, and they often finish only when they are close to retirement.

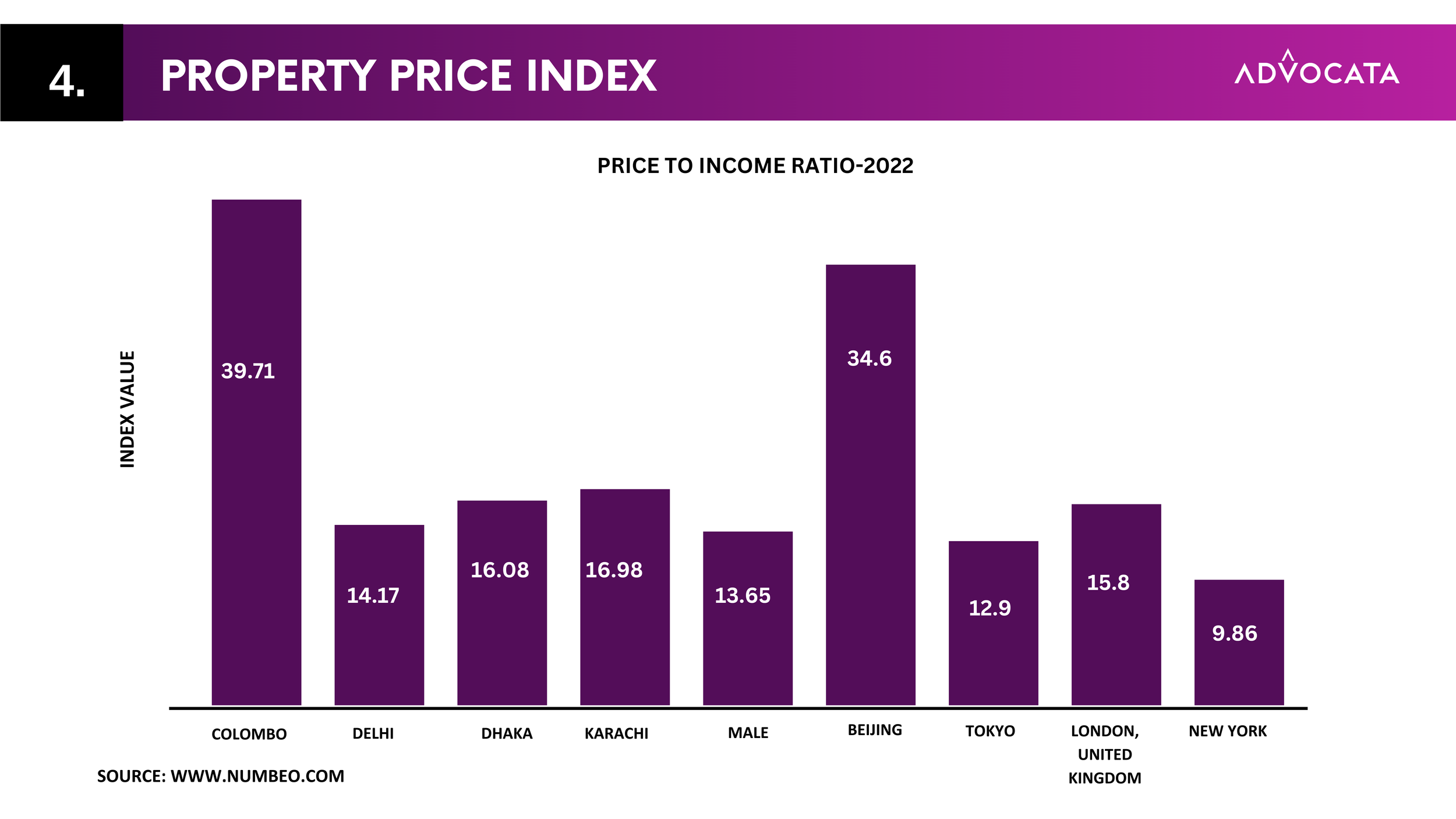

A few years ago, Advocata research showed just how bad the situation was. Sri Lanka’s housing affordability is among the worst in the world, worse than New York, Tokyo, or London. We rank only behind Shanghai. In simple terms, compared to how much we earn, our housing costs are higher than in some of the richest cities on earth.

Even lifetime savings don’t take us far. A Sri Lankan in the 70th income percentile can only afford a 500 sq ft house. To buy a modest 1,000 sq ft house, you need to be in the top 20% of earners.

Why is housing so expensive? The answer is simple: construction materials are outrageously costly because of sky-high import tariffs. Wall tiles, floor tiles, cement, steel, bathroom fittings, you name it, are all slapped with layers of taxes: CESS, PAL, Customs duty, VAT. Sometimes these add up to over 100%.

Some argue tariffs don’t matter since Sri Lankan companies make many of these products locally. But if that’s true, why do we need tariffs at all?

The reality is that imported materials are often 50–75% cheaper than local products. Once tariffs block competition, local manufacturers raise their prices too. And when tariff rates cross 70% or 100%, imports stop coming in entirely. So the Government doesn’t earn much revenue either; most Customs income actually comes from vehicle imports, not construction materials.

Take the numbers: cement in Sri Lanka costs about 120% more than in China. Steel is 48% more expensive than in Singapore. Tariffs on tiles and bathware are above 70%.

This is not just about houses. High construction costs spill into the whole economy.

Every industry needs buildings and energy. When our costs are higher than the region, our businesses become uncompetitive. Since most construction is financed through bank loans — often at interest rates around 12% — these inflated costs also bleed into debt burdens for families and companies alike.

The Government itself pays the price. Each year, capital expenditure is a major budget item, and inflated costs mean taxpayers get less value for every rupee spent. The tourism sector suffers too. Hotels are expected to renovate every five to seven years, but when construction is so costly, they either delay upgrades or pass the expense onto visitors, hurting competitiveness.

And look at our negative list in trade deals. Most construction materials are excluded, meaning they will stay protected even under free trade agreements. That says a lot about who benefits from keeping costs high.

For small and medium-sized enterprises, the story is even worse. Expanding a workshop, building a new facility, or even basic repairs all become nearly impossible when construction costs are inflated and when credit is tight.

If the Government is serious about helping industries, boosting competitiveness, and giving relief to the middle class, it must bring down the cost of construction. And that means cutting tariffs.

It’s time we cared as much about the housing struggles of ordinary Sri Lankans as we do about the houses of former presidents.