By Dhananath Fernando

Originally appeared on the Morning

The Central Bank of Sri Lanka (CBSL) released its Annual Economic Review for 2024 a few weeks ago. At first glance, the dashboard of key macroeconomic indicators paints a remarkably positive picture – so positive, in fact, that some may wonder if the numbers have been massaged. But scepticism fades when you step into a grocery store or speak with a small business owner. The improvement in economic stability and the business environment is palpable.

What is particularly striking is that the new Government, while not having introduced bold new reforms, has also not derailed the stability programme set in motion over the past two years. This continuity, though passive, has helped preserve the gains made.

Amid the political contestation over who deserves credit for the economic stabilisation, one truth stands out: Sri Lanka’s turnaround is rooted not in politics, but in the application of sound economic policy.

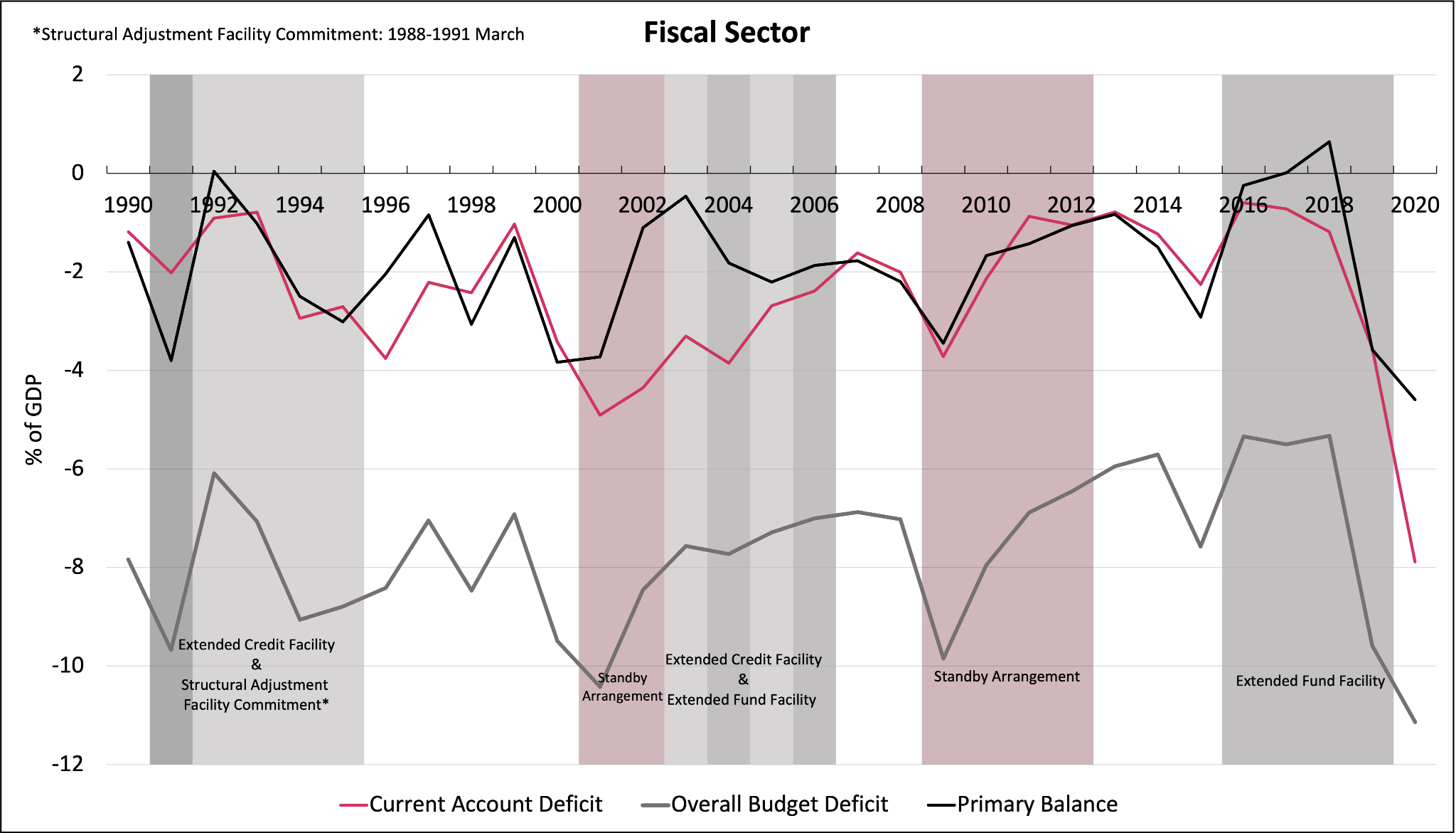

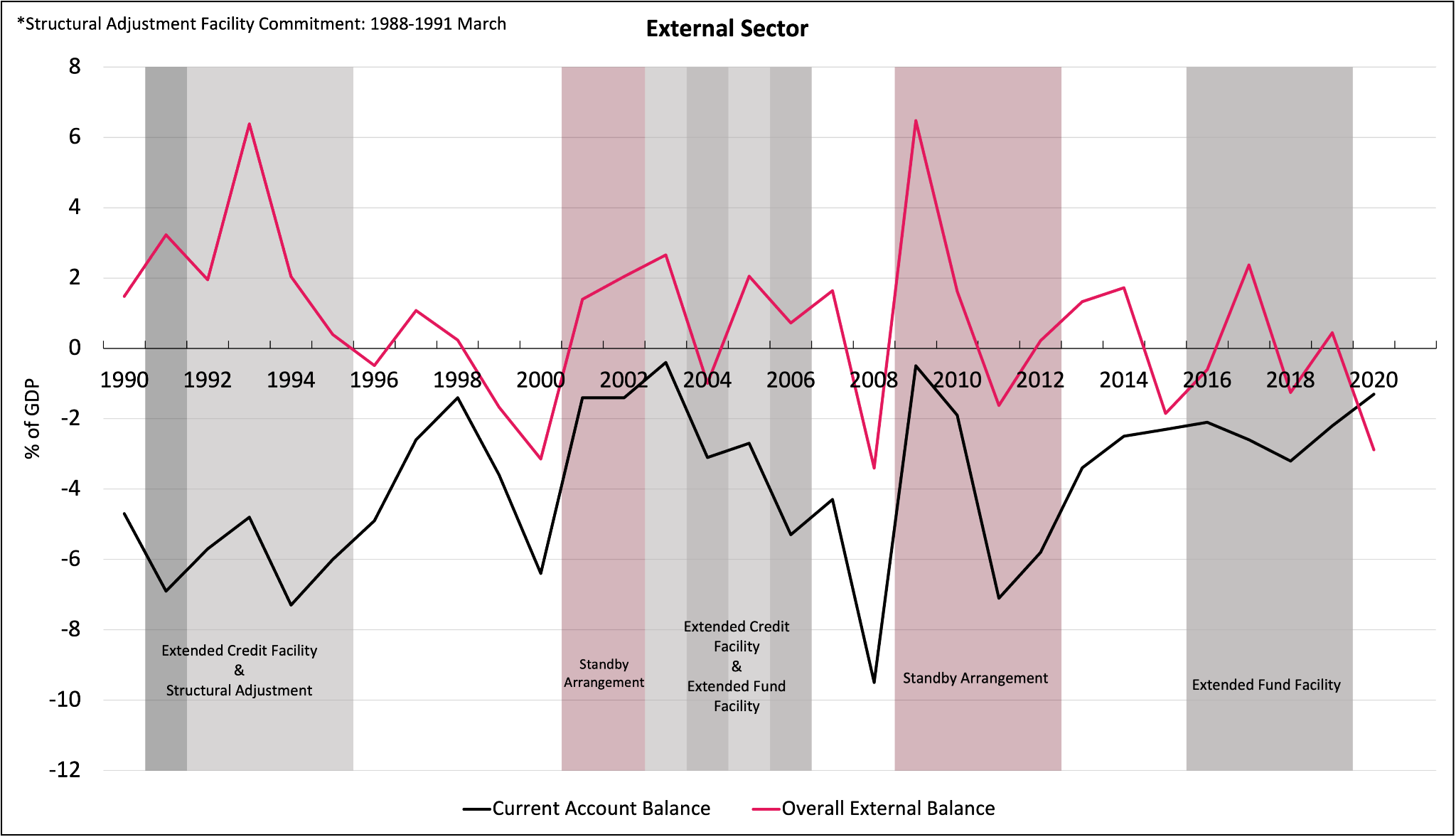

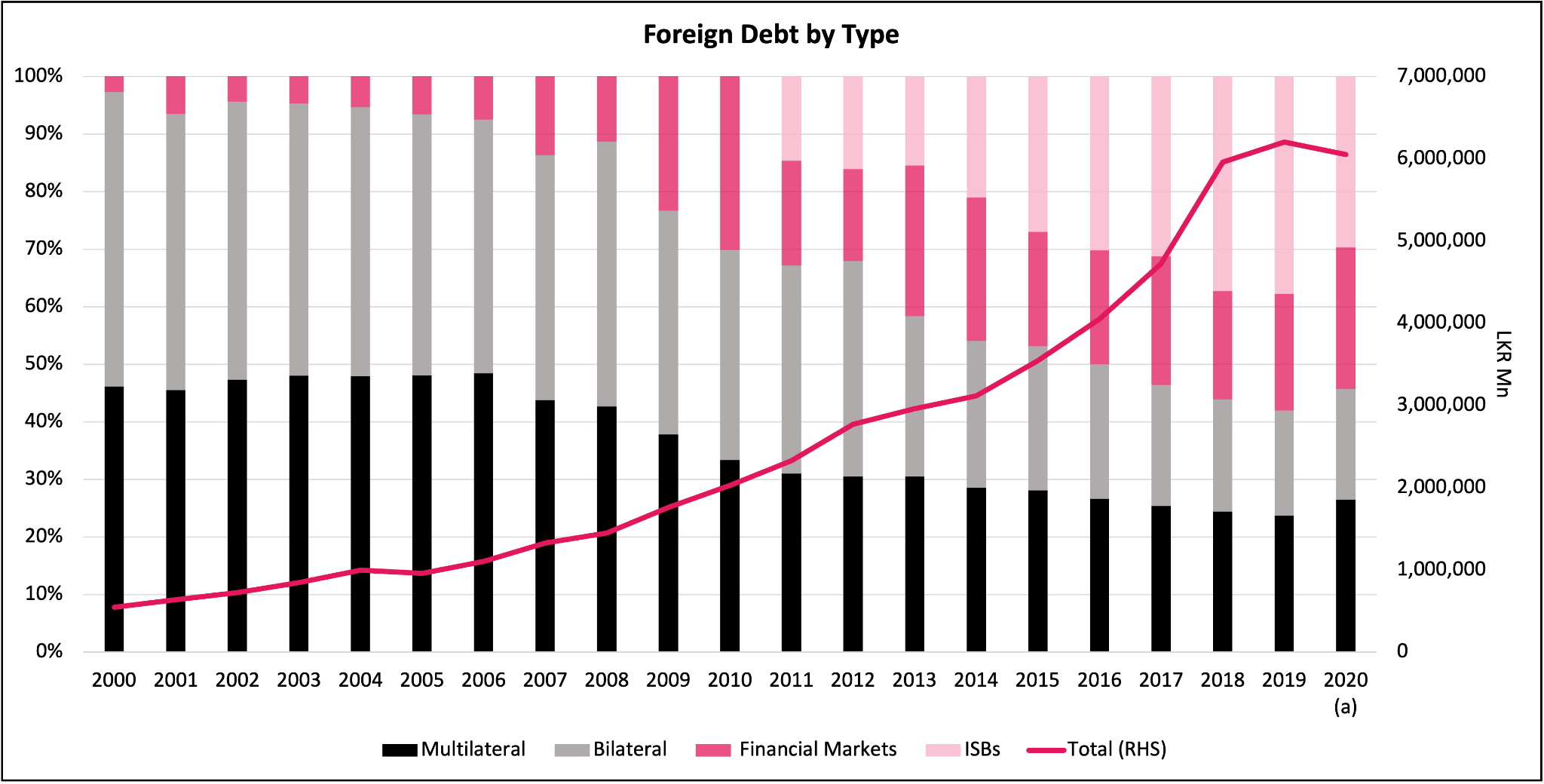

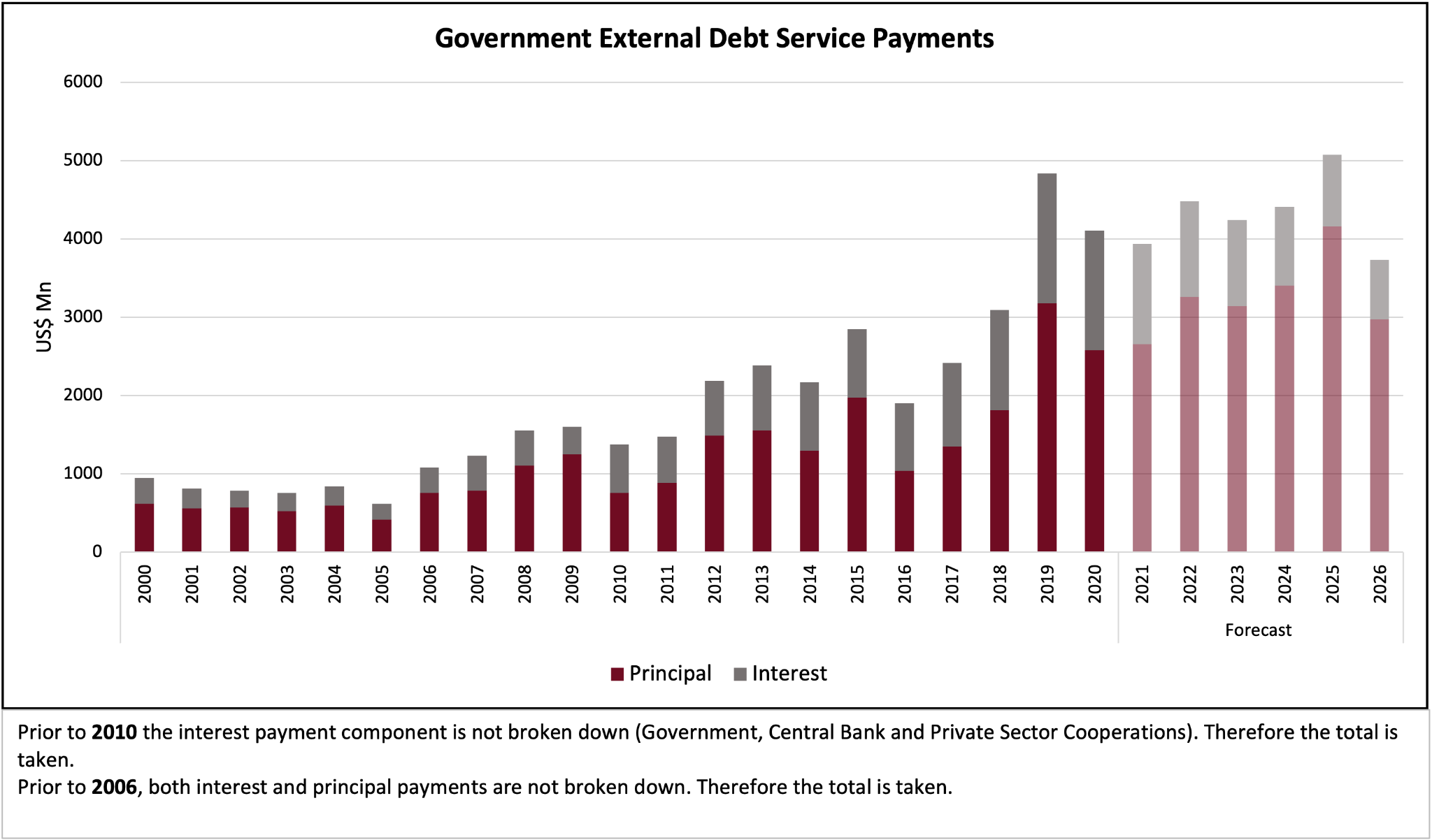

Let us not forget the chaos of the recent past. During the Covid-19 crisis and its aftermath, policies such as import controls, arbitrary currency pegging, and a misplaced reliance on Modern Monetary Theory (MMT) for deficit financing led us to the brink of collapse. We banned imports of everything from vehicles to turmeric and foreign reserves fell to critically low levels. In 2022, inflation peaked at a staggering 70% and we defaulted on our sovereign debt.

In contrast, 2024 tells a very different story. Imports have been liberalised, the Sri Lankan Rupee has appreciated, and annual inflation has dropped to just 1.2% – a sharp fall from the 42% recorded in 2022. Foreign reserves have risen to $ 6.1 billion and investor confidence is slowly returning.

If import bans and deficit monetisation were truly effective tools for reserve accumulation and currency stability, today’s numbers should be worse, not better. What changed is not just the numbers but the mindset.

The real driver behind this turnaround has been institutional reform and disciplined economic policy-making. The passage of the CBSL Act of 2023, which established the institution’s independence – though not perfect – was instrumental. It marked a break from the belief that the CBSL should finance the Government or steer economic growth through monetary accommodation. Restoring the CBSL’s credibility and prioritising price stability has laid the foundation for today’s macroeconomic stability.

However, we are far from the finish line. Stability is a prerequisite, not a destination. Without deeper structural reforms, this fragile recovery can quickly unravel.

Reforms in land use, labour markets, and immigration are essential for long-term growth. The Economic Transformation Act, parts of which are yet to be implemented, must be expedited to attract foreign investment and create job opportunities for Sri Lankans.

Meanwhile, we must interpret some headline statistics with caution. For instance, Sri Lanka’s per capita GDP is now estimated at $ 4,500 – a significant increase. But this is partly due to demographic shifts; population growth has slowed, with increased emigration and declining birth rates. The Department of Census and Statistics now estimates the population at just over 21 million. Additionally, a stronger exchange rate and subdued inflation have boosted the dollar value of nominal GDP.

Yes, economic growth in 2024 stands at 5%, but we must be mindful of the base effect. Following two consecutive years of contraction, this figure reflects a rebound from a low base, not a high-growth trajectory.

Still, the numbers on inflation, reserves, and interest rates underscore a clear commitment to macroeconomic stabilisation. Even the returns to the Employees’ Provident Fund (EPF) have improved, an indirect benefit of preserving the value of money, or what economists call ‘sound money.’

The bottom line: this recovery is the result of disciplined policy, not political manoeuvring. But policy cannot stand alone. Without a resilient institutional framework, good policies can be reversed with the next election cycle. We often adopt ‘scientific policy’ only when a crisis forces our hand. That culture must change.

As the country prepares for the upcoming Local Government Elections, it is crucial for the Government to demonstrate that it is serious about reforms and institutional strengthening. Assuming that 2025 will bring equally good numbers by doing more of the same is not just naive, it is dangerous. Without changing gears, we risk reversing the progress made and returning to instability.