By Dhananath Fernando

Originally appeared on the Morning

The President celebrates one year in office this week. Anniversaries are not just milestones for celebration but moments for reflection. After the first year, it is important to pause, assess performance, and take a look back at how the Government has fared.

We can measure it in two ways: against the promises made in the manifesto or against the real impact it has created. Manifestos, however, are written in a different time and often fail to account for the speed at which global dynamics shift.

What matters more is how a government adapts to unexpected events and whether it can remain steady in its commitments while being flexible in its tactics.

Navigating global shocks

For this Government, the most immediate test came in the form of external tariffs imposed by the United States. For an export-dependent country like Sri Lanka, this was no small matter. Yet, through negotiations and careful positioning, the Government managed to secure rates comparable to those faced by competitors such as Vietnam, Indonesia, Thailand, and Bangladesh.

This outcome was not perfect; Sri Lanka did not secure special exemptions or a breakthrough advantage, but in relative terms, it ensured that exporters were not left at a severe disadvantage. Given our vulnerability, parity itself can be considered a modest success.

Staying the course on economic anchors

The more significant achievement, however, has been in what the Government chose not to do. In Opposition, it was deeply critical of the International Monetary Fund (IMF) programme, debt restructuring, and even institutional independence. In office, it resisted the temptation to reopen these debates.

The IMF agreement is not a magic pill for growth, but it is an anchor of credibility. Bilateral and multilateral partners are only willing to extend support if Sri Lanka remains within the framework. Re-negotiating or exiting would have shattered fragile investor confidence. The decision to stay the course despite earlier political rhetoric is one of the Government’s strongest moves.

Equally important was continuity in the bureaucracy. Retaining senior officials like the Treasury Secretary and the Central Bank Governor, despite earlier criticism, signalled stability. The Central Bank’s independence — once challenged in court by the same political actors — was not overturned. In a country where ad hoc shifts in policy have been the norm, these decisions represent a break with the past.

Policy consistency and digitisation

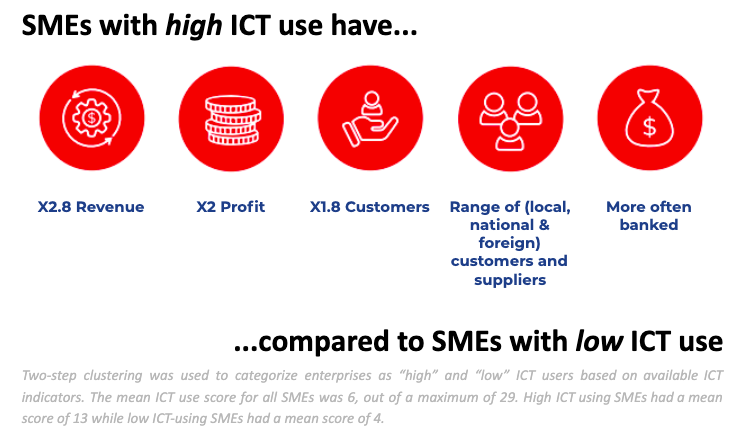

The Government has also placed a clear emphasis on digitisation. This is not glamorous politics, but it is critical for modernising the State.

Investment in digital platforms, citizen-facing services, and e-governance can reduce corruption, cut red tape, and improve trust. Execution here will matter more than announcements, but the focus is right.

Where it fell short

Yet, the record is mixed. The first 100 days, a period traditionally reserved for hard reforms, lacked decisive moves on growth. This was a lost window. Early political capital is invaluable, and reforms delayed are often reforms denied.

On electricity, the amendments pushed through were poorly thought out. While the sector desperately needs investment to modernise the grid, the structure presented remains too complicated to attract private capital. This has left both investors and consumers uncertain. The result: more delay in a sector central to growth.

The casino regulation bill was another missed opportunity. Instead of a carefully designed framework to maximise foreign exchange inflows and create predictable tax revenues, the rushed bill left loopholes and generated criticism.

Properly regulated gaming could have been a valuable source of revenue, especially given the need for fresh dollar inflows, but haste undermined credibility.

A mixed scorecard

Looking at the first year as a whole, the Government can claim several wins:

Managing global tariff shocks without falling behind competitors

Staying in the IMF programme and pushing debt restructuring forward

Maintaining institutional continuity and not reversing Central Bank independence

Prioritising digitisation as a long-term reform

At the same time, its shortcomings are notable:

Failing to push through bold, growth-driven reforms in its first 100 days

Weak design in critical reforms like electricity

A poorly structured casino bill that squandered an opportunity for new revenue

The road ahead

The next stage will be harder. Stabilisation was the first priority; growth must now take centre stage. Without growth, fiscal adjustment will remain politically painful, and social patience will wear thin. The Government must focus on reforms that can unleash private investment by simplifying tariffs, unlocking land titles, and modernising State enterprises.

Above all, it must resist the temptation of short-term populism. Stability has been bought at a cost, but it will only pay off if the Government uses this breathing space to create conditions for long-term expansion.

Anniversaries are for both reflection and recommitment. As the Government marks one year, the people expect not just steadiness in storms but boldness in calm. If the first year was about survival, the second must be about growth.