Sri Lanka’s possibility of debt default is real, the Colombo-based public policy think tank Advocata Institute said, yesterday. Launching its latest publication, “A framework for Economic Recovery”, Advocata’s Senior Research fellow Dr. Roshan Perera said that the country is facing one of the worst macroeconomic crises in its history and with rapidly depleting foreign reserves position and the Government’s limited options to finance its foreign debt service obligations will adversely affect the nation’s debt sustainability. Therefore, they urged the policy makers to identify, prevent and address macroeconomic imbalances that could adversely affect the economic stability of the country.

Sri Lanka’s economy has been characterised by twin deficits, i.e., it has run both a fiscal deficit and a deficit in the external current account. This implies that the country has been spending and consuming more than it earns and produces.

“Priority should be given to correcting the twin deficits, stimulating economic growth and improving competitiveness while building buffers to strengthen the resilience of the economy to shocks”, it stated. According to their observations, fiscal dominance has been the root cause for macroeconomic instability adversely affecting growth, inflation, interest rates and the exchange rate. Fiscal indiscipline has also significantly narrowed the space for monetary policy.

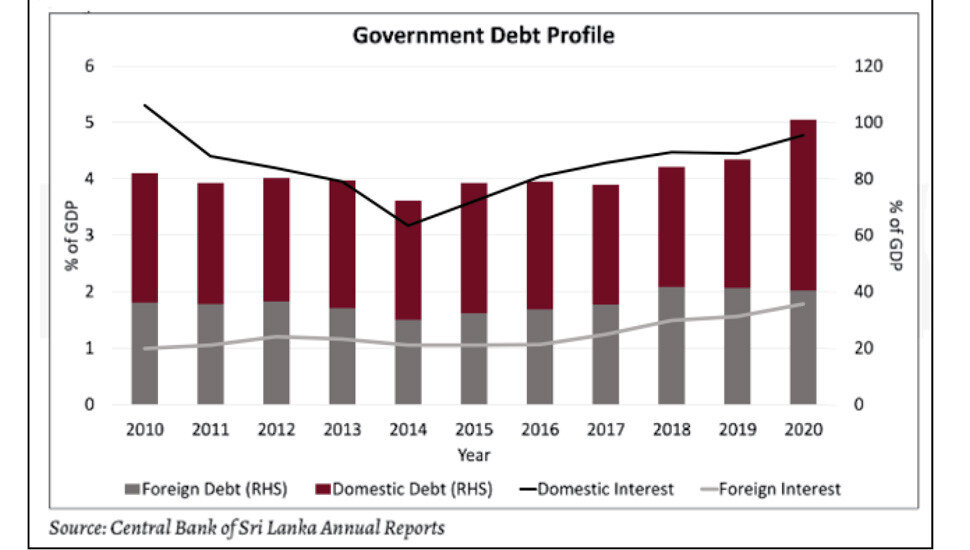

“Weak public finance management arising from inadequate revenue collection and uncontrolled expenditure has meant the Government has continued to run budget deficits, relying on borrowings to finance the shortfall. This has led to high and unsustainable debt levels,” the report stated. According to the Advocata, completing the Extended Fund Facility (EFF) programme entered into with the International Monetary Fund (IMF) in 2016 would be imperative to restoring macroeconomic stability.

Read the full article here

Top panel sounds alarm, insists it’s time for urgent economic reforms

Sri Lanka should carry out urgent and credible economic reforms to create a stable environment to emerge from one of the worst economic crises in its history triggered by unsustainable spending, debt and stifling controls, a panel of economists said.

“There is no doubt that Sri Lanka is facing a severe economic crisis. Macroeconomic stabilisation is the need of the hour,” said Advocata Institute Senior Research Fellow Dr. Roshan Perera, addressing the online event to launch Advocata’s latest publication, ‘A Framework for Economic Recovery’. Advocata is a Colombo-based think tank.

Providing a breakdown of the economic challenges before the economy, in her presentation Dr. Perera stressed on the need for immediate reforms to tackle unsustainable public debt.

The report identifies that the macro-economic instability lies in the failure of the State to implement deep structural economic reforms for nearly 20 years. The COVID-19 pandemic has exposed fundamental weaknesses that have plagued Sri Lanka’s economy for a long period of time.

The event included comments from experts on Advocata Institute’s Board of Advisors.

“None of these policy prescriptions are new. We have talked about them for years, but it's a matter of political will to implement them. We have hit a brick wall and we need to come together as a whole and take responsibility,” Advocata’s Academic Chair Dr. Sarath Rajapatirana said.

Read the full article here

Economists call for an extensive review of the tax system to improve revenue mobilisation

An improvement in Sri Lanka’s revenue mobilisation effort requires an urgent and extensive review of the tax system, to ensure the government can meet its expenditure commitments, while the country is in the midst of one of the worst macroeconomic crises in its history, economists said.

Pointing out that the national economy is heading towards a “precipice”, Colombo-based economic think-tank Advocata Institute asserted in its latest publication titled ‘A Framework for National Recovery,’ that the “serious erosion” in government revenue and its implications for macroeconomic stability call for a comprehensive review of the tax system.

According to the report, some of the areas that require attention include; reducing the tax threshold and widening the tax base, reintroducing the PAYE and WHT, reducing the excessive reliance on indirect tax as it is currently at about 80 percent, rationalising tax incentives, introducing new taxes, and strengthening the tax administration.

Currently, the income tax threshold in Sri Lanka is four times its per capita GDP, and also higher than the tax threshold in countries with per capita incomes that are several times that are of the island nation. The report recommends bringing down the threshold while also adopting measures to bring in employees into the formal sector so the tax base is widened.

Read the full article here

Key Ways to Boost Revenue

Making tax administration technology driven, instituting land tax and removing tax exemptions are among three ways that Sri Lanka can boost revenue, Advocata Institute, a think tank, in a recent report, said. The think tank in a report titled ‘A Framework for Economic recovery’ dated July said that Government of Sri Lanka (GoSL) revenue which was 21 per cent of GDP in 1990 was averaging 15 per cent during the period 2005-2009. ‘This has plummeted even further to around eight per cent by 2020,’ it added. The key revenue earner for GoSL is taxation. ‘Further, around 80 per cent of tax revenue collected in 2020 was from indirect taxes, increasing the regressivity of the tax system, with lower income earners bearing a higher burden of taxation,’ the report warned.

There is also a significant concentration of taxes collected from a few commodities such as tobacco, liquor, motor vehicles, and food and beverages, said Advocata. This also increases the regressivity of the tax system as some of these are considered essential items and form a higher proportion of the consumption basket of low income earners, the think tank further warned. In order to broaden the tax base, new taxes such as land taxes should be introduced, the think tank advocated. Meanwhile, despite commissions set up to review the tax system, as well as donor funded programmes initiated to address the weaknesses in tax administration there, has been very little progress on this front, said Advocata.

Read the full article

Look at options to meet debt obligations - Advocata Report

An independent policy think tank launching its latest publication; “A Framework for Economic Recovery” in Colombo last week called on policymakers to pay serious attention to consider all options available to meet the country’s debt obligations which is in the tune of around US $25 billion in foreign debt between now and 2026. The report by the Advocata Institute presents a framework for macroeconomic stabilisation and emphasises the need for urgent economic reforms. The panel comprising well-known economists and heads of think tanks urged policymakers to look at all options to meet the obligations as there could be a possibility of defaulting on debt obligations which would reflect badly on the country.

The urgency to seek ways and means to meet the obligations or restructure debt was underpinned due to the fast depleting foreign reserves estimated at US $ 2.8 billion as at the end July this year, foreign inflows affected by the pandemic and negative investor sentiments.

The author of the report and Senior Research fellow of Advocata, Dr. Roshan Perera said debt restructuring is not an easy task and added that the possibility of resuming a program with the International Monetary Fund should be looked into.

Read the full article

Defaulting debt repayment can have severe repercussions

Sri Lanka has been running deficits over the decades following the post- independence period when the fiscal deficit was over 10 percent of the GDP.

In 2020 it exceeded 10 percent of the GDP and is likely to deteriorate in 2021. “If the government continues to consume more than it earns or when the domestic private savings are not sufficient to finance the economy it can reflect in our current account deficit. In the absence of domestic saving, the country has to depend on foreign savings to bridge the current deficit,” said Dr. Roshan Perera, Senior Research Fellow of the Advocata Institute at the launch of a publication on “Framework of Sri Lanka’s Economic Recovery at a webinar held this week.

She said in the absence of FDIs coming into the country Sri Lanka had to borrow from abroad. In the 2000 period funds came mostly from bilateral and multilateral sources and concessional financing. But these funds ceased when the country’s rating was elevated to a middle- income country status. When Sri Lanka embarked on infrastructure projects in later years, it had to borrow from private lending agencies and international sovereign bonds with shorter grace periods with higher interest rates. This had an impact on debt service payment which has ballooned over the years. With low foreign inflows coupled with the COVID-19 pandemic, debt servicing has been a challenge, she added.

Read full article

Poor economic performance linked to poor economic governance: Experts

Sri Lanka’s poor performance across multiple areas in the economy is linked to the economic governance of the country weakening over the years, despite an ever expanding public sector, according to some leading economists and practitioners of law in the country.

As having the right institutional strength is essential and imperative for an economy to prosper in the medium to long term, top economists and legal practitioners this week attributed the repeated issues faced by the country to the grim economic governance, which remains unaddressed and unacknowledged.

According to Emeritus Professor of Public Law Suri Ratnapala, a starting point for Sri Lanka in this regard would be to initiate the process of rebuilding institutions of the state, judiciary, enforcement agencies and auxiliary organisations that support the legal system.

Read full article

Addressing Sri Lanka’s macroeconomic imbalances

We are 18 months into the pandemic but the policymakers are yet to announce a proper programme to save Sri Lanka from the economic crisis it is currently facing now. Although many policymakers blame the Covid-19 pandemic for the current economic situation, by now many have realised the pandemic just unveiled the curtain behind which all the troubles of Sri Lanka’s economic system were kept hidden.

Colombo-based think tank Advocata Institute, on 14 September unveiled a Framework it has prepared for Sri Lanka’s Economic Recovery. The report was prepared by Advocata Institute Senior Research Fellow and Central Bank of Sri Lanka (CBSL) former employee Dr. Roshan Perera.

Presenting the report, she said that for consumers and producers to be able to make long-term decisions there needs to be stability in the economy and highlighted what is really meant by stability.

Read full article

Resolving the economic crisis and facing challenges with reforms

Dr. Rajapatirana pointed out that Sri Lanka’s trade as a percentage of GDP has been low compared to Thailand and Vietnam because we have not exploited our opportunity to trade as we have high tariff rates compared to other developing countries.

Furthermore, although tariffs play a role in protecting domestic infant industries, if tariffs are too high, they can become anti-competitive. Dr. Rajapatirana observed that recent import restrictions, such as banning a wide range of consumer goods from April 2020, have further worsened Sri Lanka’s growth potential and put Sri Lanka at odds with WTO rules.

Read full article

Sri Lanka cronies profiting from import controls, SMEs battered: Samarajiva

Sri Lanka’s so-called cronies who benefit from customers trapped under state controls are raking even more profits from current import controls, while smaller firms are getting wiped out, a policy specialist and liberator of poorer consumers said.

Many domestic businesses also needed inputs.

“Import controls are creating a lot of opportunities for permit holders and cronies to make money,” Rohan Samarajiva, founder of LirneAsia, a regional policy advisory group told a forum organized by Advocata Institute, a Colombo-based think tank.

Read full article

Is economic recovery possible?

“The economy should grow steadily and sustainably. It should have a sound financial system, be resilient to shocks with inflation under control,” said Dr. Roshan Perera, Senior Research Fellow of the Advocata Institute during a recent webinar on building a framework for economic recovery in Sri Lanka. Explaining that in the economical environment, there are internal and external imbalances to be found, she said internal imbalance consists of issues such as the government spending limitlessly, too much money in the economy and uncertainty. Whereas external balance means a combination of inflation and exchange rates that makes imports more attractive and exports uncompetitive. This includes abrupt changes in the exchange rates that call for financial assistance and in the extreme defaulting on payments to the rest of the world, she explained.

Read the full article