Originally appeared on Colombo Telegraph, Citizen.lk, The Morning, Lanka Business Online and Daily Mirror

By Aneetha Warusavitarana

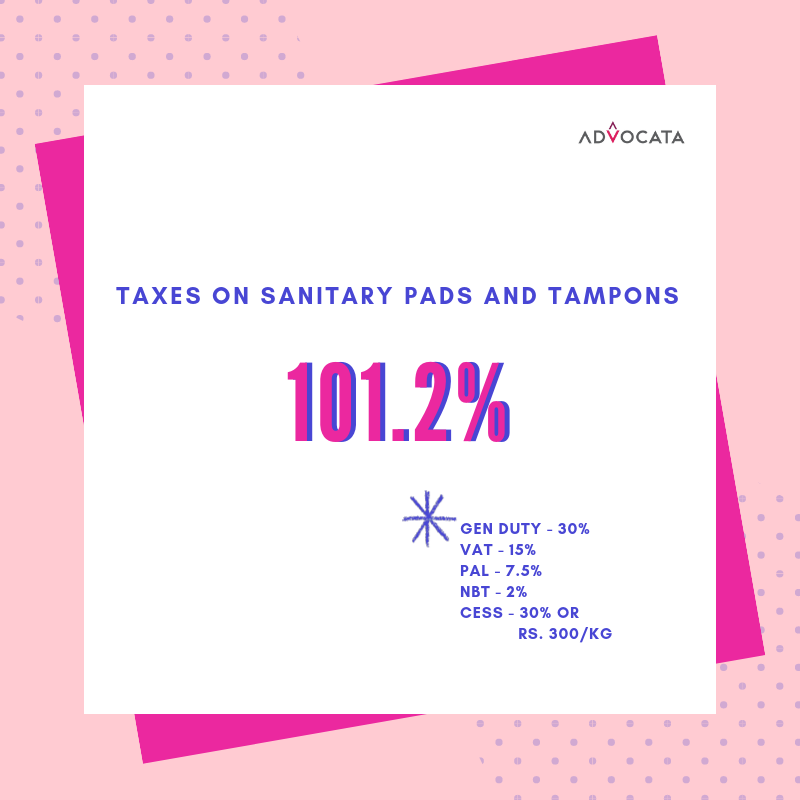

Sri Lanka’s exorbitant taxes on sanitary napkins had the media spotlight over the last few weeks - this is not a new issue. In 2018 the total tariffs on sanitary napkins was over 101.2%. Since then we have seen some progress, with the tax being reduced from 101.2% to its current rate of 52%; a result of several tax revisions.

The 2020 budget revised down general duties for sanitary napkins to 15% and introduced a CESS tax of 15%, causing an uproar in social media and in parliament leading to fresh calls for the abolition of these taxes.

Menstrual hygiene products are essential for girls and women, and this issue has put the interests of these consumers who want more variety and cheaper products against the interests of the local producers who want larger margins. Since the initial uproar last week, there have been claims that the local brands account for 95% of the local market and therefore import taxes do not have a bearing on the market price.

Bringing the debate back to where it matters: impact on women

It is clear that for this issue, policy decisions have to be taken with the best interests of the consumer at heart - in this case, the millions of menstruating women.

At the most basic level of analysis, when protectionist tariffs are placed on a good, it is the consumer who loses out. The tariffs will achieve two things: they will limit the range of products that enter the domestic market, and they will raise the prices of both imported products and locally manufactured products. How so? The inputs into the local production process are also taxed, which raises production costs, and therefore raises the final price of the locally manufactured product. Additionally, the tariff raises the price of the imported product, which allows local producers to raise their prices and keep substantial margins. In other words - tariffs cause both the locally produced goods and the imported goods to be sold at a higher price.

These tariffs are also keeping more affordable options out of the market. At the time of writing, locally manufactured products can range in price (per pad) from LKR 11 to LKR 19. However, cheap imported alternatives are not available. For example, Indian supermarkets have products at the equivalent of LKR 5. The tariffs may not be deterring higher-priced imports from entering the market, but it could be possible that this is happening with more affordable imported options - it makes little sense to bring in a cheaper product if the tariff raises your costs to the point where you have to price the final good at the same price point as your more expensive product.

Will removing the tax only affect high-income earners?

An argument leveled against the removal of the tax has been that imported products are often out of reach of the average Sri Lankan woman, and as such has little relevance as a policy decision. This argument has also been coupled with the statement that as locally manufactured products exist, and women do purchase them - why should we care about bringing in imports?

The example provided above makes it clear that removing the tax would actually bring more affordable products into the market. This is also where the importance of choice comes to play. Each woman will have different requirements at different points in their life. This is compounded by the fact that menstruation is often accompanied by pain and discomfort, which can range from mildly annoying to debilitating. In short, one size does not fit all when it comes to menstrual hygiene products. In response to this fact, the global industry has innovated - period cups, period underwear, reusable pads and more. These tariffs should be removed, and Sri Lankan women should also be given access to these choices.

Economic Rents

By now it should be clear that there is only one winner, and it is not the millions of menstruating women. The basic explanation of the impact protectionist tariffs have is that they serve to benefit local producers, that are few in number. They shield them from the competition and allow them to price well above marginal costs. A classic case of ‘rent-seeking’ behaviour, where a company lobbies to secure itself protection in order to charge a higher price. The result is that the local consumer loses out.

There is one area where the producer's complaints do have merits - that is the tariffs placed on their inputs. Much of the input that goes into the production of sanitary napkins are also taxed. The government should look into reducing these costs to help the local manufacturers stay price competitive.

Given this, there is a clear call to reform - prioritise the requirements of women, and remove the taxes imposed on the final good and on the inputs into the production of these goods.

Aneetha Warusavitarana is the Research Manager at the Advocata Institute and can be contacted at aneetha@advocata.org or @AneethaW on Twitter. Learn more about Advocata’s work at www.advocata.org. The opinions expressed are the author's own views. They may not necessarily reflect the views of the Advocata Institute, or anyone affiliated with the institute.