අනුකි ප්රේමචන්ද්ර

කාන්තවන්ගේ ඔසප් වීමට සාමාන්යයෙන් කියන්නෙ පීරියඩ්ස් කියල.

කාන්තාවන්ගේ සාමාන්ය පීරියඩ්ස් වලට අසාමාන්ය බදු ගැසීමට සහ ඔසප් වීම පිළිබඳ ඇති මිත්යා මතවලට එරෙහිව නැගිටිය යුතු කාලයයි.

ඔබ බොහෝවිට මේ ගැන නොදන්නවා වෙන්නට පුලුවන්. ශ්රී ලංකාවේ ඔසප් වීම පිළිබඳව සහ ඔසප් සනීපාරක්ෂාව පිළිබඳව සමාජයේ ඇති කතිකාවත එටරම්ම ගැම්බුරු නැහැ. එමනිසා සමහර විට ශ්රී ලාංකාවේ කාන්තාවන්ට ඔසප් වෙනවාද යන තරමටම අපේ සමාජ කතිකාවත ප්රාථමිකයි. ඇත්තටම කතාව තමයි ශ්රී ලංකාවේ කාන්තවන්ගේ ඔසප් සනීපාර්ක්ෂාව ඉතාම දුර්වලයි. ඔසප් වීම සහ ඔසප් සනීපාර්ක්ෂාව පිළිබඳ අධ්යාපනය අඩු වීම, සමාජයේ ඔසප් වීම පිළිබඳ තිබෙන මිථ්යා මත වගේම විවෘතව මේ මාතෘකාව කථා කිරීමට බිය වීමම දුර්වල ඔසප් සනීපාක්ෂව ඇති වීමට හේතු කිහිපයක්.

දුර්වල ඔසප් සනීපාරක්ෂාව නිසා බොහෝ ශ්රී ලාංකික කාන්තාවන් අනෙක් රටවල් වල කාන්තාවන්ට වඩා සිටින්නේ පිටුපසින්.

ශ්රී ලංකාවේ සනීපාර්ක්ෂකතුවා භාවිතය සලකන්නේ සුභෝගභෝගී භාණ්ඩයක් විදියටයි. එහෙමත් නැත්තම් කලු වෙළඳපොලේ විකිනෙන භාණ්ඩයක් ලෙසටයි.

ශ්රී ලංකාව තුල සනීපාරක්ෂක තුවා සහ කාන්තා සනීපාරක්ෂාව පිළිබඳ මිත්යා මත සහ සමාජ පීඩනය නිසා දිනපතාම සනීපාර්ක්ෂාව අතින් අපි අත්ත දුප්පත් තත්වයට පත්වෙමින් තිබෙනවා.

ඔසප් සනීපාර්ක්ෂාවෙන් දුගීවීම

ඔසප් සනීපාර්ක්ෂාවෙන් දුගීවීම කියන්නෙ කාන්තාවන්ගේ සනීපාර්ක්ෂාවට වියදම් කිරීම මිල අධික වීම සහ එම වියදම් දරා ගැනීමට අපහසු වීමයි.

ශ්රී ලංකාව මෙම ප්රශ්ණයට තදින්ම මුහුණ දෙන රටක්. සාමාන්යයෙන් වෙළඳපොලේ සනීපාර්ක්ෂක තුවා විකිනෙන්නේ රු. 120 - 175 ත් අතර මිලකටයි. ආනයනය කරන වෙළඳ නාම රු. 350 දක්වා මිලකටයි අලෙවි කරන්නේ. එම නිසා ආනයනික සනීපාරක්ෂක තුවා මිලදී ගැනීම කාන්තවන්ට සිහිනයක් පමණක් මෙන්ම එය සුපෝගභෝගී භාණ්ඩයක් බවට පත් කර තීබෙනවා.

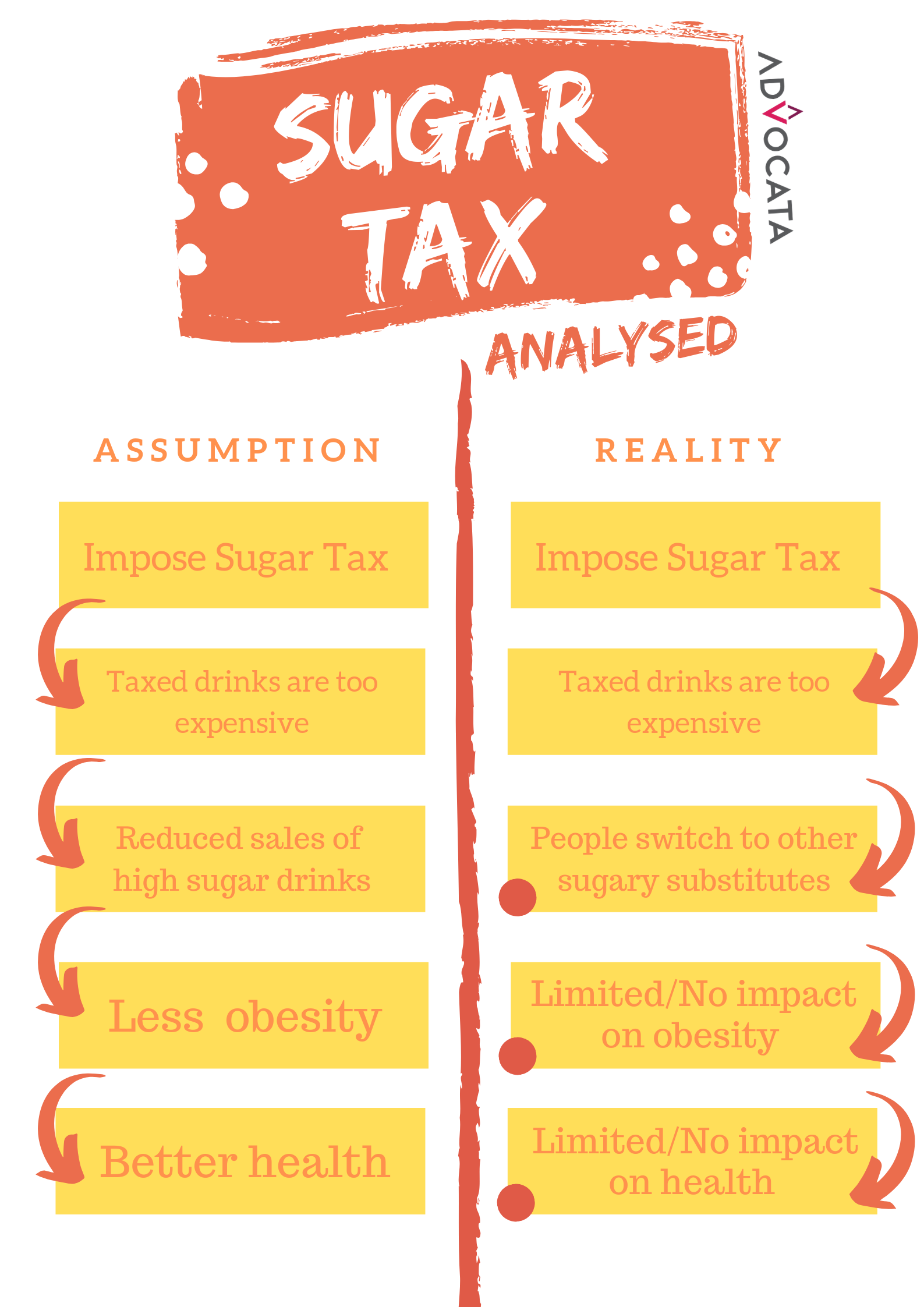

ආනයනික සනීපාරක්ෂක තුවා එතරම් මිල අධික වීමට ප්රධාන හේතුව රජය අයකරන අසීමාන්තික සහ අසාධාරණ බදු ප්රමානයයි.

2018 සැප්තැම්බර් මාසයේ සනීපාරක්ෂක තුවා සඳහා අය කරන මුලු බදු ප්රමාණය 102% සිට 62% දක්වා මුදල් අමාත්යතුමා අඩු කරනු ලැබුවේ එවකට පැවති සෙස් බද්ධ ඉවත් කිරීමෙන්. මෑතකදී මුදල් අමාත්ය මංගල සමරවීර මැතිතුමා රොයිටර් පුවත් සේවයට ප්රකාශ කර තිබුනේ පාසල් දැරියන්ගේ සහ කාන්තාවන් ආර්ථිකයට එකතු කර ගැනීමට කාන්තා සනීපාරක්ෂාවට පනවා ඇති ඉතිරි බදු ප්රමාණයත් ඉවත් කරන බවයි.

සාමාන්යයෙන් කාන්තාවක් තම ජීවිත කාලය තුල දින 2535 ආර්තව කාල නැතහොත් ඔසප් කාල ගත කරනු ලබනවා. එක්වර බැලූ බැල්මට එය එතරම් දීර්ඝ කාලයෙක් ලෙස නොපෙනුනත් එය වසර හතක පමණ දීර්ඝ කාලයක්. කාන්තවකට ඉතා අවම සනීපාර්ක්ෂක තත්ව යටතේ ඔසප් කාල වලදී සනීපාරක්ෂකතුවා වල මිල අධික වීම නිසා රෙදි කඩවල් භාවිතයට තල්ලු කිරීම සාධාරණ යැයි ඔබ සිතනවාද?

සනීපාරක්ෂක තුවා සුපෝගභෝගී භාණ්ඩයක් බවට පත්වීම ඉතාම කණගාටුදායක තත්වයක්. මිලෙන් වැඩි අත් ඔරලෝසු සහ සුවඳ විලවුන් සුපෝගභෝගී භාණ්ඩ ලෙස සැලකෙන්නේ එම භාණ්ඩ සමාජයේ ඉහළ ආදායමක් උපයන පිරිසට පමණක් මිලදී ගත හැකි නිසයි. පවතින බදු ක්රමය දැන් සනීපාරක්ෂක තුවා සුපෝගභෝගී භාණ්ඩයක් බවට පත් කර තිබෙනවා.

මෙම වසරේ කාන්තාවන්ගේ ඔසප් සනීපාරක්ෂාව පිළිබඳ ජාත්යන්තර දිනයේ තේමාව "ඔසප් වීම කාන්තවාට බලපායි" යන්නයි. පසුගිය සතියක ප්රසිද්ධ ඉරිදා පුවත්පතක පල කර තිබුනේ නාගරීකරණය වීම සමඟ දැන් "නවීන" කාන්ථාවන් මහදවල් සුපිරි වෙළඳසැල් වලින් සනීපාරක්ෂක තුවා මිළඳී ගන්නා බවයි. එම පුවත් පත් වාර්ථාවට අනුව කලින් කාන්තාවන් සනීපාරක්ෂක තුවා මිලදී ගත්තේ ඉතාම රහසිගතව සහ බ්රවුන් පේපර් කවරයකින් එතීමෙන් අනතුරුවයි. එයින් තහවුරු වන කාරණයනම් තවමත් සනීපාරක්ෂකතුවා විවෘතව මිලදී ගැනීම අනුමත නොකරන බවයි.

අවාසනාවට කරුණ නම් අපි පිළිගැනීමට අකමැති වුවත් ලිපියේ කතෘ දරණ මතයම සමාජයේ තවත් බොහෝ දෙනා දැරීමයි. මම පසුගිය දිනක නුවර සිට නැවත කොළඹ පැමිණෙන අතර මඟ සාමාන්ය සිල්ලර කඩයෙකින් සනීපාර්ක්ෂක තුවායක් මිලදී ගත්විට කඩයේ මුදලාලි මෙම සනීපාක්ෂක තුවාය කඩදාසි ගණාවකින් ඔතා ඉතාම රහසිගත ලබාදුන්නේ හරියට මම ඔසප් කාලයක් පසුකිරීම මහා අපරාධයක් ලෙස සලකමිනුයි.ඔසප්භාවය ගැන කථාකරන විට සමහරු සංස්කෘතියට බනිනවා. සමහරු සමායයේ තිබෙන මිථ්යා මතවලට දොක් නගනවා. නමුත් අවසාන ප්රතිථලය මිලියන 10.5 තරම් කාන්තාවන් ආර්ථව චක්ර දිළිඳුභාවයට පත්වීමයි.

ඔසප් චක්ර පිළිබඳව ගැරහීම ආර්ථව දිළිඳුබව ඇති කරන්නේ කොහොමද?

සනීපාර්ක්ෂක තුවා සැඟවමින් විකුනන මේ සෙල්ලම ඔසප් චක්ර පිළිබඳව වැරදි මත ගණනාවක් සමාජගත කරනවා. හරියට කාන්තාව මත් කුඩු මිලදී ගන්න තත්වයට සනීපාරක්ෂක තුවායක් මිලඳී ගැනීම සමාන කරනවා. කාන්තාවකට මෙතරම් අත්යාවශ්ය භාණ්ඩයක් කලු කඩයේ විකුණන තත්වයට සමාජයේ ඇති කුමන හෙතුවක් පත් කලත් එහි අවසාන ප්රතිඵලය වෙන්නේ කාන්තාවන් සනීපාරක්ෂක තුවා මිලඳී ගැනීමට භය වීම සහ අධෛර්යට පත් වීමයි. සනීපාර්ක්ෂක තුවා පිළිබඳ සමාජයේ ඇති දුර්මතවල කොතරම් බරපතලද කියනවනම් වෙළදසැල් වල මෙය විකුනන්නේ සඟවාගෙනයි. එයම හේතුවක් වෙනවා කන්තවන් එම සනීපාර්ක්ෂක තුවා වල මිල, ප්රමතිය පිළිබඳ විවෘතව කථා නොකිරීමට. ඕනෑම මාතෘකාවක් සඟවා කතාකිරීමෙන් මෙවැනි තත්වයක් ඇතිවීම වැලැක්විය නොහැකියි. අපි ඇකමැති සනීපාරක්ෂක තුවා සන්නාම අපිට අකමත්තෙන් වැඩි මිලකට, අඩු විවිදත්වයක් සහිතව ගැනීමට සිදුවීම මෙහි අවසන් ප්රතිඵලයයි.

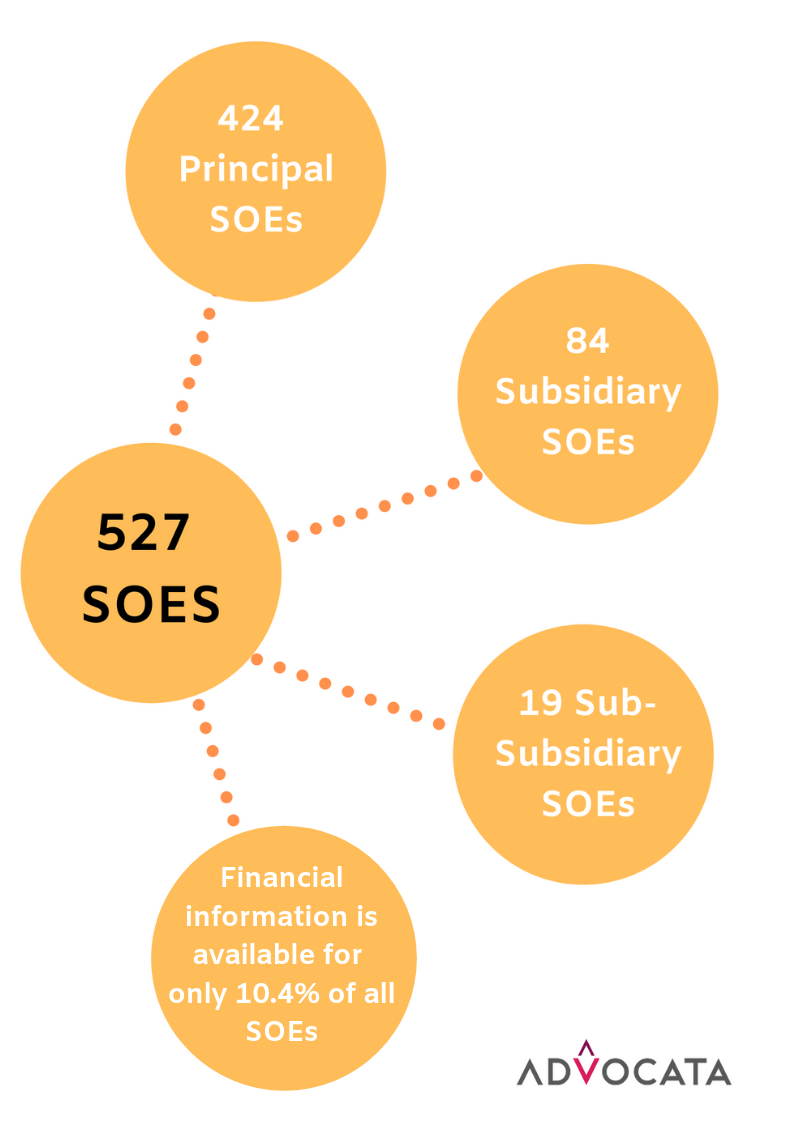

ශ්රී ලංකාවේ සනීපාරක්ෂක තුවා වෙළඳපොළ දේශීය වශයෙන් නිපදවන සන්නාම කිහිපයක් මඟින් අත්පත් කරගෙන තිබෙනවා. එම දේශීය වෙළඳනාම වලට ආර්ක්ෂාව සැපයීම සඳහා ආනයනික සනීපාරක්ෂක තුවා සඳහා ඉතා ඉහල ආනයනික බද්දක් අය කරනවා. අපගේ අසල්වැසි ඉන්දියාව සමඟ සැසඳීමෙදී අපගේ රටේ විකිණෙන සනීපාරක්ෂක තුවා වල විවිධත්වය ඉතාම අවමයි. එක් එක් කාන්ත්වාට අවශ්යා සනීපාරක්ෂක තුවා වර්ග එකිනෙකට වෙනස්. එය තීරණය වන්නේ එම කාත්වාගේ කායික සොභාවය සහ ලක්ෂණ අනුවයි.

සනීපාරක්ෂකතුවා කලු වෙළඳපොළේ විකිනෙණ භාණ්ඩයක් ලෙස සැලකෙන නිසා ලෝකයේ අනිත් වෙළඳපොලවල් වල දක්නට ලැබෙන නැවත සේදිය හැකි සනීපාරක්ෂක තුවා, කාබනික කපු වලින් නිපදවෙන සනීපාරක්ෂකතුවා, නැවත භාවිතාකලහැකි සනීපාරක්ෂක තුවා ලෙස ඇති විවිධ නිෂ්පාධන කාණ්ඩ දැක ගැනීමට නොහැකියි. අපිට උදාවී තිබෙන තත්වය තමයි අපිට නොගැලපෙන, අපි ඇකමැති සනීපාරක්ෂක තුවා වැඩි මිලකට මිලට ගැනීම. මේ පිළිබඳව හඩක් නගන්නටවත් කවුරුවත් එක්නොවෙන තරමට සමාජ මතය සනීපාරක්ෂතතුවා මහා රහසිගත කලුකඩ භාන්ඩයක් කර හමාරයි.

නැහැ, ඔබ මිලදීගන්නා සනීපාරක්ෂක තුවා පැකැට්ටුව කොලවලින් ඔතා ලබාගැනීමට තරම් රහසිගත සහ භයානක මත්කුඩු වර්ගයක් නොවෙයි.

නැහැ, අසීමිත ලෙස බදු ගසා සමාජයේ කිහිපදෙනෙකුට පමණක් මිලදී ගැනීමට හැකිවන ලෙස ඉතා ඉහල මිලකට අලෙවි කලයුතු භාණ්ඩයක් නොවේ සනීපාරක්ෂකතුවා.

කාන්තාවක් විදියට මම ඔබෙන් කාරුණිකව ආයාචනා කරන්වා කාන්තවනේ ඔසප් වීම පිළිබඳ විවෘත සංවාදයකට එකතුවන්න කියල. සමාජයේ ඔසප් වීම පිළිබඳ දුර්මත සහ විකාර මත වෙනස් කරන්න අපි එකතු වෙමු. සනීපාරක්ෂක තුවා සුපෝගභෝගී භාණ්ඩයක් නොවෙයි. ඔසප් වීම සාමාන්ය ජීව ක්රියාවලියක් වෙද්දි සනීපාරක්ෂක තුවා සුපෝගභෝගී කිරීම හරිම අසාධාරණ නැද්ද?

View this article in English here.