Originally published in Echelon

Much of Sri Lanka’s money problems can be traced to its weak income tax.

By Ravi Ratnasabapathy

It may seem paradoxical; the idea that higher taxes will spur economic growth. The theory goes that high taxes are a drag on growth by taking away resources from people and companies that can otherwise be productively deployed. However, in poor and middle- income countries, where tax collections relative to the size of the economy is low, the opposite is often true. Taxes help pay for critical infrastructure and social services; without roads, schools and hospitals, private sector wouldn’t invest.

Poor countries struggle to raise adequate tax revenue to pay for public infrastructure. This is the cost of being poor; most people are penniless, and much of the economic activity is in the informal sector, which puts it beyond the taxman’s reach.

Businesses and wealthy people who should pay tax on profit or income don’t feel compelled to do so because the government is usually corrupt, infrastructure derelict and nobody else is paying taxes anyway. Income tax that businesses and self-employed pay on their profit, and those with jobs pay on their income is relatively easy to dodge. Although tax dodging, also called evasion, is a criminal offense gathering evidence to prove this is impossible where cash transactions are the norm, and companies don’t keep detailed records.

The other primary tax source is consumption. A country with enough resources invested in the administration can successfully enforce consumption tax by requesting companies pay a portion of turnover as tax. Enforcement is easy because it’s a simple, efficient and difficult to evade tax.

Since, consumption tax has evolved into taxing just the value addition at a higher rate than the entire turnover at a relatively low rate. Poor countries, on average, collect the equivalent of 13% of GDP in taxes. In the rich world, this number is around 34%. Middle-income countries have tax collections that fall in between those collected in the poor and the rich.

Sri Lanka is not a poor country. In fact, in 2019, when per capita GDP crossed the $4,000 threshold, it was classified as an upper-middle-income country. It rose above abject poverty ranks following the economy’s opening to market forces in the late nineteen seventies.

During the years between 1950 to 1989, the government’s tax take averaged 21 percent collected in income tax, turnover tax and import levies, combined. (see Chart 1) Sri Lanka’s total tax income as a percentage of GDP has since fallen to 11.9% in 2018, lagging behind all its developing country peers in taxto- GDP: Georgia 24%, Samoa 23%, Ukraine 18%, Armenia 17.5% and Tunisia 21%, according to IMF data.

Tax collections as a percentage of GDP now are lower than those of even sub-Saharan Africa. The Center for Tax and Development estimated three years ago that the average tax take in sub-Saharan Africa rose from 12% of GDP in 1990 to 15.1% by 2018. The turnaround in sub-Saharan Africa is due to the implementation of value-added tax, and the creation of autonomous tax agencies. Sri Lanka’s main challenge is that at the equivalent of 2% of GDP, the income tax contribution to revenue is low. The government had set a goal in its medium-term economic plan to increase income tax contribution to total tax revenue from 20% to at least 40%. Income tax is paid by companies on profits, and individuals on their earnings.

However, in 2018, three years after that announcement, income tax-to-GDP stood at 2.1 percent. This is also a much lower rate of collection than Sri Lanka’s peers in the middle-income group: Georgia and Mongolia have 9%, Bhutan 7.7%, Samoa 5.6% and even troubled Egypt has 6%. If the income tax to consumption tax ratio is to improve from regarded as a comfortable level for equitable growth, income tax-to GDP-must reach at least 6% assuming no taxes and rates are changed.

A tax-paying population will keep governments honest, since taxpayers will want to see that their money is not squandered or worse, stolen. Even the United Nations’ Millennium Development goals included an aspiration for all countries to at least raise tax income equivalent to 20% of GDP. Mick Moor, who is the founding Chief Executive of the International Centre for Tax and Development (ICTD) of UK, identified five factors that have led to the quarter-century-long revenue decline in Sri Lanka.

Some of the problems are clear. Income tax evasion here is widespread for an economy in Sri Lanka’s state of development, the tax code has too many loopholes making it easy to avoid taxes (which isn’t an offence), Sri Lanka’s revenue department not being an autonomous agency, and broadly because governments have failed to adapt to significant changes in economic structure, by modernising the revenue system.

Moor, who published “The Political Economy of Long-Term Revenue Decline in Sri Lanka” in 2017, makes five main arguments. The first is the declining electoral pressure of large scale public spending on welfare.

Sri Lankan governments from the 1940s to 1970s undertook large scale spending on social welfare. Unusually high human development indicators were a result of mass state supply of health, education and subsidised food.

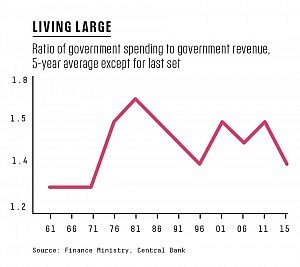

However, since the revenue was high during those decades, it was possible to sustain a ratio of government spending to government revenue of over 1.3 to 1.7 times, without too many adverse implications. (see Chart 2)

Tight budget deficit management has been a feature since the present government took office. As a result, the ratio of government spending to income has declined in the four years to 2018 to 1.4 times. By containing costs, domestic taxes now cover all recurrent expenses, excluding interest payments. The trend is impressive because its a feat previously only achieved a few times, since independence.

However, so far, it has not managed to improve overall revenue. Income tax revenue, the weakest component of the tax structure are rising, although, in the overall revenue, they are still too small to show an impact. Income taxes accounted for 18 percent of total revenue during the January – April 2019 period, after Value Added Tax, which contributed 27 percent and excise duty, which brought in 22 percent.

Total revenue from income tax increased by 9.6 percent to 104 billion rupees in the first four months of 2019, from a year ago, with revenue generated from corporate and non-corporate income tax up 10.2 percent to Rs43 billion. Revenue generated from Pay-As-You-Earn (PAYE) tax increased by 18.6 percent to Rs22.4 billion in the eight months to August 2017 from a year ago. This was because employee incomes rose and tax administration became more efficient, according to the finance ministry’s Fiscal Management Report – 2018.

The second reason for the declining revenue; is the availability of easy foreign aid. Following the 1977 general election aid flows increased rapidly. Suddenly governments were able to, without much pressure, run much larger budget deficits. During the 1970s and 80s, the demand and prices for Sri Lanka’s commodity exports began to decline impacting tax collections. Export taxes, now anathema, were a source of government revenue then. During the five years to 1975 export taxes contributed 11%, and in the five years to 1980, 23% of annual government revenue. By the late nineteen eighties, import taxes had all been eliminated.

Tax exemptions for foreign and local investments are the third factor in the steep tax revenue decline. By 1982 the Greater Colombo Economic Commission, the precursor to the Board of Investment, had both the authority to grant tax holidays, and took over the power of Customs in the management of the Export Processing Zones. Foreign investors, besides, received generous depreciation allowances and duty-free permits, for all investors and not just for those producing for export. Sri Lanka’s policy of the President holding also the job of the Finance Minister eroded the urgency for focusing on revenue, and adapting the tax department to significant changes in the economic structure. Except for 29 months between December 2001 and April 2004, when the government and the executive were from two parties, the president has also held office as Finance Minister.

Mick Moor suggests there is strong evidence that the absence of a powerful minister of finance has undermined revenue collection. An absentee finance minister is the fourth reason for ineffective revenue performance. The fifth challenge is its high reliance on taxing imports to make up for the poor tax revenue performance. Import duties have long been a significant source of revenue, because they are easy to collect. Compared to the late 1930s, Sri Lanka remains similarly reliant on taxing imports for revenue. (see Chart 3) World over governments revenue is earned mainly by taxing income and consumption. Because of the many economic growth impairing eff ects of taxing imports, many counties do so only sparingly.

Ignored so far but in Sri Lanka are property taxes. So far property tax implementation, including land tax, at municipal council level has been crude. It’s a tax that naturally falls on those who can afford to pay, and is an efficient tax since it does not discourage productive activity. It was only the relative ease with which the plantation economy could be taxed that generated a high tax rate in the mid-twentieth century. Income tax has raised significant revenue since 1932. Self-assessment was introduced as early as 1972 and a relatively sophisticated turnover tax introduced in 1963. This was replaced by VAT in 1998. That income tax success revered after 1990.

Now they generate about a third of the revenue it should be making. Instead of serving the population around a third of revenue is consumed by an exploding bill for civil servants, and another third of revenue for pensioners. Weeks ago the government announced pay and pension hikes and thousands of new state sector jobs. More tax will not disappear into an ever more bloated bureaucracy. Th ere is also light at the end of the tunnel.

Sri Lanka’s last constitutional amendments permit only members of parliament can be appointed ministers. Th e president will not be able to hold ministerial posts in the future. A powerful minister to manage finance can ensure revenue targets are met.

Improvement in revenue administration via a cloud-based application known as RAMIS of the Inland Revenue Department also helped improve the tax collection mechanism. Its already showing results in enhancing income tax collections. If indeed income tax collections do rise because the wealthier sections are paying their share of taxes on income, property values and other wealth, the underfunded public education, health and social protection systems can be fixed. The government implemented in 2015 new revenue-raising measures with some success. Taxes are never popular, and there are no easy ways to overcome such resistance.