Originally appeared on The Morning

By Dhananath Fernando

I studied at a semi-government school. Students studying in these schools pay a school fee every month. Due to financial constraints, some students found it rather difficult to pay this fee. As a solution, we decided to organise a food fair to raise funds as opposed to collecting money, which we thought would be a direct burden on most parents. The fair required students to bring food that was tradable. I remember referring to this as a “salpila” in Sinhala. Most parents contributed by sending in homemade food items such as hot dogs, sherbet, short eats, faluda, and sweetmeats.

However, the food fair faced a significant challenge. We were only permitted to have the fair within the 20-minute lunch break and were strictly advised not to disturb the academic timetable for the day. I was not too pleased with this and proudly suggested a “brilliant” idea to increase the demand and sales of our little “salpila”. My “brilliant” idea was to close down the school canteen during the lunch break on that particular day, so students will be left with no choice but to purchase from the “salpila”. However, to my dismay, the then principal explicitly turned down my request. He then explained to me how short-sighted my proposal was.

It was then that I was introduced to the concept of “rent-seeking. Rent-seeking is the manipulation or alteration of the market for financial gains. This exactly was what we had proposed. The principal went on to question us on how we could match the demand of 3,000 students and the plight of the canteen owner who was on a rent agreement with the school.

I argued back, questioning “what is the big loss the canteen owner is going to make just for closing down the canteen for 20 minutes” and “why can’t the principal support us in such a noble effort of assisting our classmates to continue their education”. Our principal explained to us that bending the rules to make profit is not the way to do business or to help our classmates. However, he said that we can compete with the canteen focusing on goods that are not available there.

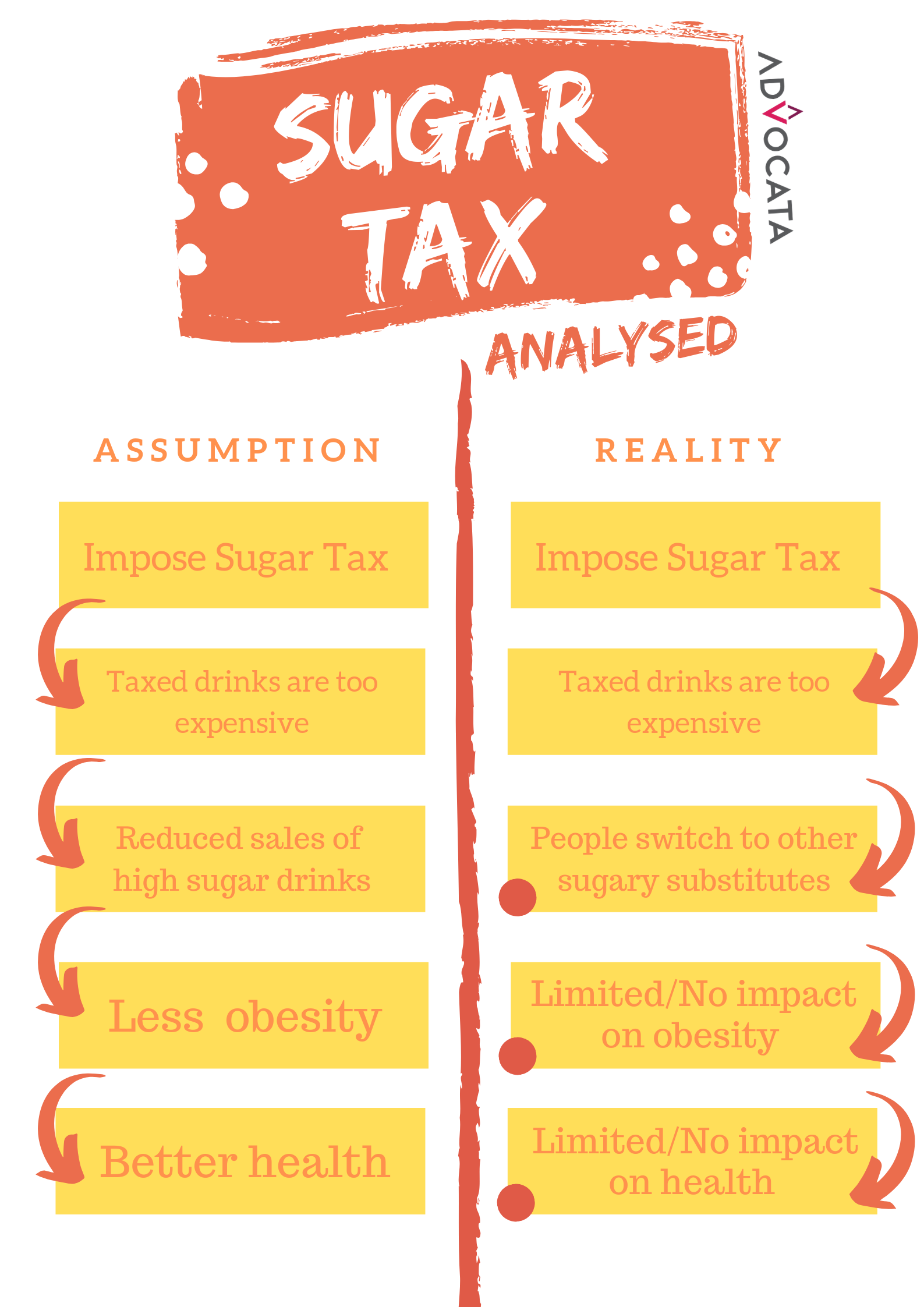

Now, as an adult, every time I see an overnight gazette notification or stories of import taxes on sugar, CESS on tiles, import duties on menstrual hygiene products, I revisit my school days and my short-sighted thought process which I believed to be “brilliant” at the time. The most recent story on the matter is the sugar importation conundrum which took the limelight with the COPA report. There is one school of thought that it is just a revenue loss for the government and there is another school of thought that this is a fraud. However, it is clear that the consumer has become the net loser. It is unfortunate that the discussion is not on the economics of it but rather pointing fingers at each other and comparing which losses are greater: Bond fiasco or sugar tax reduction.

Overnight gazettes: Open window for fraud and corruption

Having low duties on imports is always better for imported commodities as ultimately the tax has to be paid by the consumer. While the taxes have to be low, it is equally important for the taxes to be consistent and predictable so the room for market manipulation is limited. On the other hand, using quantitative restrictions to limit imports would encourage rent-seeking, a concept proposed by Prof. Anne Krueger.

It has become the habit of all consecutive governments to impose various import duties and taxes on various import items which affect the prices drastically. When the taxes are changed overnight in significant amounts inconsistently across and selected commodities, it will act as a barrier for small players to enter into business as they do not have the capacity to absorb tax losses or match massive quantities as it is difficult to decide on prices.

As a result, the importation of commodities such as sugar only has a handful of importers who act as an oligopoly and can manipulate market prices. Especially when taxes are brought down from large amounts such as from Rs. 50 to 25 cents, there is a higher chance of getting insider information and manipulating the market. As a result, few traders have the opportunity to get to know information early and bring in stocks early and store in bonded warehouses where only the taxes are applicable on rates where the consignment is released. This allows them to take the tax advantage by keeping prices unchanged. Or in worst cases, taxes can be brought down overnight and it can be increased again overnight, favouring a few individuals just after the goods are cleared at the port, and this is how the overnight gazette notification opens the window for rent-seeking. This can be seen every time when a budget is presented and many speculations float around on the vehicle market and many other commodity markets.

Consecutive governments are of the belief that overnight gazette notifications have become a tool to raise revenue for the government as well as to regulate markets, and this sugar tax has proved that it is not only a completely ineffective tool, but also a window for corruption.

Government’s policy inconsistency with tax policy

One of the main reasons provided by the Government to keep the corporate tax and income tax unchanged is to provide policy consistency so the business can predict future trends and support growth. The same thinking process needs to be applicable for indirect taxes as well. Both direct taxes as well as indirect taxes have similar consequences when it comes to inconsistency. Finance Ministry officials have agreed that high tariffs on sugar add a burden on the cost of living and that is one reason to bring down taxes, which is the right way to think about it.

At the same time, we should not forget the tariff on other commodities such as tiles, bathware, menstrual hygiene products, construction steel, other food items, cement; all product categories and commodities too add to the cost of living of people. When we have double and multiple standards on tariffs, that too distort markets and open opportunities for rent-seeking.

The policy of self-sufficiency has been challenged

On the other front, with the reduction of sugar tariffs, acknowledging that the tariffs have caused to increase the prices and shrink the supply has proved that self-sufficiency in sugar is an impractical concept to achieve. In a recent interview, Trade Minister Bandula Gunawardana has mentioned that import controls caused small-scale exporters who export coconut-related products and food items to be badly affected. The same argument has been highlighted by this column since the day the self-sufficiency policy was pronounced, highlighting the consequences on both losing our export markets, volumes, as well as our export competitiveness.

Imports restrictions by themselves cannot cause pressure on the LKR, as it does not reduce the demand for sugar. What can cause pressure on the rupee is the ill-managed Monetary Policy that causes the pressure on the LKR and the balance of payment crisis. After serious import controls and trade restrictions, that is one reason why the rupee has achieved a historic low last week.

Though how good may be our intention, not knowing the right concepts not only distorts markets, but also brings united consequences for people and their quality of life. Like my principal advised me many years ago, the way to combat issues is not by rent-seeking but by competition.

The opinions expressed are the author’s own views. They may not necessarily reflect the views of the Advocata Institute or anyone affiliated with the institute.