Thank you. I want to thank Advocata for inviting me to be here this morning and I read with interest what Advocata is doing and also about the Fraser Institute and its work, particularly work relating to economic freedom.

I am going to make some general comments and maybe also, quickly take up some of the issues that [previous speaker] Anushka raised so that we could think about it a little bit more deeply, I guess as your day progresses.

As you know, in Sri Lanka our issue is that the government’s stake in the economy is very big-it’s much bigger than we think. Just to illustrate it, the advocates of the right to information and me being one, very vociferously talking about it while in the opposition, and supporting the present speaker even when he brought a private members bell to parliament to get the right to information, now sitting on the other side and trying to implement the right to information, still strongly believes in the principle of the right to information, but I also realize some of the practical issues that have also arisen.

For example, I was having a discussion with some friends the other day and I was telling them you know you don’t realize when you ask some information, that I’d rather not give it you because if it is commercially sensitive information unlike in other countries in which you are monitoring, in Sri Lanka the state is so big in the economy that if I give you that information it will affect the state institutions’ competitiveness, vis-à-vis, those in the private sector that are competing. Now something that we have never really thought about. So we have the state which has commercial entities, maybe around 250 commercial entities in the economy.

So our fiscal dynamics don’t really support this as we move more and more towards eliminating, or minimizing the fiscal deficit. so the government is trying to create an environment in which, because of its low savings in the economy of inviting investment and foreign investment, looking at ways and means of sharing the risk and also having structures like the PPP structures and models to optimize the return on state assets.

Unfortunately, a few years ago we had this situation where there was enabling legislation to expropriate some assets. I must say that this was a very negative signal and detrimental to the economy. The present government does not agree with what happened and steps will be taken to repeal such legislation.

On the area of property rights, and private property rights I would say, that these must be exercised with responsibility, particularly to the environment and to negative externalities and pollution and so forth. I also happen to be the United National Party Organizer for an electorate south of Colombo. One of the frequent complaints I have, and I’ll probably receive that complaint this morning because I chair the district development council at 10 o’clock this morning in the south of Colombo, is that the private companies are polluting the Bolgoda, the Kalu Ganga and all the waterways around there, so I think we have lots of issues regarding the security of property rights and we want to basically secure property rights, but secure property rights in a responsible way. In terms of monetary policy, our government has upheld the principle that the Central Bank must have its independence and can act independently. And we have recently made sure that the Central Bank has that right. I recently was in a pre budget discussion and some of the younger, if I can call them, business entrepreneurs, one of the things they told me was the Central Bank has made some comment about real estate and that it is dampening the real estate market. I quickly leaped to the Central Bank’s defence, and what I said was that the Central Bank has every right it make that statement independently of the government because we don’t certainly want to have an Asian crisis - like a Malaysia and Singapore situation - where the Central Bank was subsequently accused of really not acting in time. So we have a central bank which is free to act independently.

Exports have come down as you all know, drastically as a percentage of GDP over the last 15 years. Our government’s twin strategy is while attracting foreign investment is also to encourage trade, and particularly exports. A national export strategy has been formulated and much work has been done, and we are certainly looking at implementing some of those suggestions.

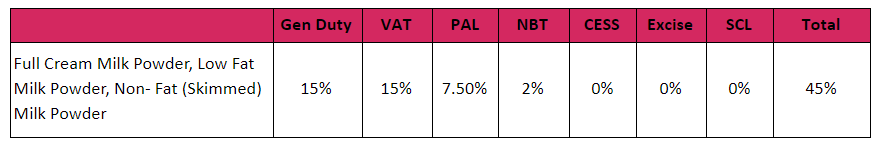

In terms of revenue that comes to government, most of our revenues are collected at the border. Whether it is the taxes on duty or other taxes in terms of efficiency of collection, are collected at the border, so more that 50% of revenue is collected at the border. About 80% of all our revenue comes to three state institutions- the customs, the excise department, and the Inland Revenue department.

So we must liberalize trade, but we have to do this in a measured way. We must bring in anti- dumping law to ensure fair trade practices. We will have to have a trade adjustment package as we adjust particularly while these domestic industries and entities, some of which will get hurt, in our move to liberalize further. We are under no illusion, and I think in Anushka’s remarks this morning he made it clear too about the imperfections of the market, ranging from information asymmetry, weaknesses in competition and also externalities. We want to have regulation, but hopefully, smart and unobtrusive legislation- institutional reform and a change in the mindset.

I would like to conclude my brief remarks by actually taking the four issues that were raised and also to show the complexity when we deal with these issues.

For example, Anushka said that in a recent exchange at the Ministry of finance that the industry pointed out that there was a lack of skills and if they were to try to get those skills from overseas, the immigration department would refer that to a line ministry and then it would be months before a response comes, and once the response comes and the process is completed, you may or may not have the requirement for the skill you were actually seeking. So that’s a very practical problem and I asked them then and there, what do you think is the solution. And they immediately suggested a solution- they said can’t you give the discretion to the controller of immigration and emigration to make that decision. This was just about two weeks ago. I had a discussion with the controller of immigration and emigration and I told him that he will be soon getting the power to make that decision. Yesterday I followed it up, and it might require a cabinet approval and the suggestion that came from the industry was very simple: just annually decide what are the skill sets you need, give him a list of the skill sets and then let him make the decision on the spot, review the list from time to time depending on the needs of the economy.

Now the reason I highlighted this was, as Anushka said, our issue often is not very large disagreements on what needs to be done, but is actually an inability to implement. I think if I were to pick one thing as a priority that needs to be done it is to focus on implementation.

Often, not often, every day almost every hour, I get phone calls saying that can we have a meeting, can we discuss something and I’ve got to the point that I just do not have time in my calendar time for meetings. This is my first meeting at 8.30 in the morning and my final meeting concludes at 12.30 tonight. And therefore we all need to do some sleeping.

So I tell people please send us a note, just a very short note with what the problem is but also include in your notes, what you think the solution is going to be. Because if I could just pick it out and send it to the relevant point of implementation, that will greatly help them and assist them and then we can monitor or get some feedback as to why it can or can’t be actually done. So implementation is actually the key. So we are open, send us a note, remember that change does not always come from the top, change often comes from the bottom because that’s where people are under pressure to change.

He also referred to the three wheelers and I really liked that, because there is this very middle class idea that “my heavens this is a menace. Can we in some way limit it or get rid of it”. Three wheelers are here to stay. They are a very important part of our economy; they are a very important part of our community. But we all understand that they need to be regulated in some way because of the undesirable aspects of that industry, too.

We are doing it in an interesting way. If a man falls from a coconut tree and gets injured, the three-wheeler was his ambulance. If there is a road accident, the three-wheeler is the ambulance. Until very recently, the districts of Hambantota, Matara, Galle, Colombo, Gampaha and Kalutara, until very recently there was no ambulance service that anybody could call. Unless you had private insurance and called your private hospital, you have virtually no ambulance. Today, we have a very modern ambulance service operating in all these cities; 93% of all telephone calls are answered within the first minute. And I’ve had a personal experience addressing a meeting like this, where somebody suddenly fell ill and I timed it, and it took 8 minutes for the ambulance to get that person from off the premises, on the road and to the hospital. When are rolling this out country wide, but before that it was the three-wheeler that was the ambulance. He talked about the three-wheeler being the last mile connectivity and I agree with it; I think it will always be the last mile connectivity. But the problem today is that it is not the last mile, it is the long mile. That’s the problem we are facing and that needs a change in government policy from getting off the highways and into public transport. Who cares about the high way? It is the politician that Anushka referred to, in his very expensive car. Or it is maybe some of you, who drive on the highway. I’ve asked audiences on places I go, and ask them how many have actually driven in the highway - sometimes I get only 2 or 3 hands in an audience of 100 people. That’s the economic benefit that people have received in terms of transport.

Of course, there are other benefits that come from a highway in terms of industry and the economy. So we need to improve our public transport and this something we need to persuade the government to do.

We have a lack of capital in the system: small savings and a lack of capital, often wondering how this could actually be handled. The government comes up with all kinds of schemes with some being elaborated on, but how do we actually overcome this problem? We are, if I could generalize, I know these generalizations are always dangerous, we are somewhat risk averse.

China is China, but China certainly does not have a risk-averse entrepreneurial culture. We are somewhat risk averse, whether it is the micro financing industry. They went with all good intentions to the North and the East and today the things they have to hear about their microfinance loans. I can understand both sides of the argument. On one side, that’s all they have- all they have, what they have is loan money and not capital. On the other hand, people that took the loans, but they actually needed some equity in their businesses even if they were female headed households but there was a lack of equity and we’ve gotten into a bind where loans have turned into equity without really intending them to turn into equity. The same is happening in small industries because of a lack of capital.

He mentioned Sri Lankan airlines in the few comments he made on state owned enterprises. Clearly there is a problem with Sri Lankan airlines. I would like to ask the question, what should we do with it? What should we do with it? It doesn’t matter who is in charge. It doesn’t matter what the management team is. Fundamentally, is there a proposition for Sri Lankan airlines? Is there a business and economic proposition for Sri Lankan airlines in the current economic context of the airline industry? My own personal view is that there isn’t an economic and financial proposition. We need to be honest with ourselves. We need to then ask ourselves the question- how much are we willing to pay, if it brings some kind of national pride to fly the flag in the air? That’s the question we need to ask ourselves. That’s a political question, that’s not an economic and financial question. A political question needs a political answer and sometimes we have to make political decisions. But I would like to say this about Sri Lankan airlines. Sri Lankan airlines was sold eight A350 900 aircrafts-long flying, broad bodied aircrafts which didn’t fit its strategy. I think the sellers also have a responsibility, Airbus industries in France also has a responsibility. They should have taken note whether a small country like ours, with a small GDP, a small airline competing internationally should have actually been sold these aircrafts. Sellers and buyers both have responsibilities in an economy. And that is unfortunate that we have had to already pay nearly 100 million dollars, in basically terminating 4 aircrafts- still 4 aircrafts on our books today.

I would not take more time responding to some of the issues that came out of Anushka’s speech but I would like to say this. I think your conference is a very important conference. I’m particularly glad about the discussion topics that you have chosen. Exchange control liberalization, property rights, improving the bureaucracy, free movement of people and then labour market reforms. Certainly, I would look forward to the deliberations and the conclusions that you reach but please send us a note on implementation and not a report. Thank you.