By Ravi Ratnasabapathy

This article originally appeared in the Daily News.

Taxes on imported sugar were increased recently to Rs.25/kg. Consumers will be shocked to learn that the tax is almost 50% of the import price, small wonder that sugar retails for over Rs.100/kg. Strangely, sugar is also subject to price control.

On one hand hefty taxes are imposed to protect the industry which cause prices to rise. On the other hand prices controls are imposed to “protect” consumers. This does not make sense.

Is protection necessary?

Sri Lanka has a small sugar industry that produces around 50,000 mt of sugar, while consumption is around 550,000 mt.

In economics, what is called the infant industry argument is often cited as the rationale for protection. Poor nations, the argument goes, benefit from having high-tech, high-value industries that produce positive spillovers -local supply chains, an expert workforce, innovative ideas. But because poor countries have little capital, their high-tech industries can’t compete with huge multinationals. So it makes sense to shield these young, promising industries behind protectionist walls for a while, letting them play in the sandbox of the domestic market until they gain the size and know-how to go out and compete in the world.

If the argument was cited in favour of protecting an industry based on advanced technology it may make some sense, but does it apply to basic agriculture?

Top sugar producers

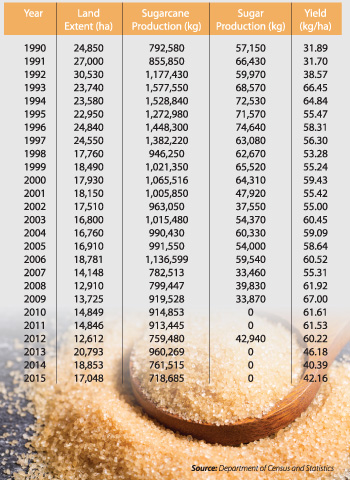

Sri Lanka’s sugar industry has been protected for the better part of forty years, the infant industry is now well into middle-age! If it has not reached the level to compete in the global market after several decades under protection it seems highly unlikely that further gains in productivity will materialise. According to data from the Department of Census and Statistics, sugarcane yield per hectare in Sri Lanka was stagnant at around 59 mt/ha between 1993-2012 before plummeting to an average 42mt/ha between 2013-2015. This is well below those of the top sugar producers.

Strangely, the data indicates that between 2009-15 while sugar cane was harvested no sugar was produced except in one year (2012). Presumably the crop was converted to ethanol, which is even more profitable.

FAO data indicates that average sugarcane yields worldwide are close to 60mt/ha but some countries produce mean crop figures of 100mt/ha and above. Of those major producers who grow in excess of 20 million tons every year, Colombia, Argentina, Australia, Philippines and Brazil usually have mean yields around 80mt/ha or more. Advantages of scale, weather, agricultural practice may all contribute, but for whatever reason the major producers do seem to have a clear advantage over Sri Lanka.

A local producer however enjoys an advantage in being close to the home market; that an importer can ship sugar halfway across the world and sell it cheaper in Sri Lanka is indicative of the extent of the efficiency of the major producers. Unfortunately the tax system prevents Sri Lankan consumers from benefiting from this greater efficiency.

Consumers are forced to pay much higher prices than they should which in effect subsidises the local production. Currently the transfer from consumers to producers is worth about Rs1.25bn rupees a year (at the new rate of tax and assuming a production of 50,000mt) which from the point of view of the sugar industry is a very handsome sum. With such riches on offer it is hardly surprising that the protected domestic market is attracting new interest.

In February this year the press reported that a foreign firm would invest US$152 m in a sugar cane project in the Uva Wellassa region of Sri Lanka. The proposed plantation will occupy about 15,000 ha which is almost double the current extent cultivated and produce 80,000 mt of sugar. Based on current tax rates it will earn a ‘subsidy’ of Rs.2 bn from Sri Lankan consumers. To put things in perspective, the annual subsidy alone would return 8.5% on the proposed investment of USD152 m.

The subsidy (and profits) will increase further if the tax rate rises, creating the incentive for further lobbying to increase the rate in time to come, burdening consumers further.

Foreign investment is a good thing but there is no good reason why Sri Lankan consumers should subsidise such a project.

Domestic industry consumers

The foreign investor in the new project presumably has access to all the latest technology, plant varieties and skills to be produce sugar efficiently. The investment should not be dependent on continued import protection. If they do not have the technology to compete with world markets should they be investing in the first place?

Having fruitlessly spent several decades enriching a domestic industry consumers should not expect to spend several more decades protecting it further. Let the investment come in by all means, but the market for sugar should be free. If there is a tax to be imposed it must be imposed equally on both domestic and imported sugar. The tax system should not create cushy markets for selected industries, who earn easy money at the expense of consumers. This behaviour is termed “Rent-Seeking” in economics.

There is nothing wrong with a business making profits, but Rent-Seeking (also called crony capitalism), which what happens when selected firms have preferential treatment is bad.

Rent-Seeking is a concept used to describe the activity of individuals or firms who attempt to obtain or maintain wealth-transfers, primarily with the help of the state. More specifically instead of making a productive contribution to an economy, a rent-seeker attempts to obtain benefits for themselves by manipulating the political environment, in this case by ensuring larger margins by taxing competing products from overseas. An activity that is otherwise not viable can suddenly become very lucrative when shielded from competition.

Competitive markets allow a nation’s resources to be used to best effect in the production of goods and services. For private investment to be a true catalyst for growth markets must be efficient and open. Distorting the market through government policy creates the wrong incentives for investors, opens the door to corruption and leaves consumers worse off.

As they do not create any value, rent-seeking activities impose large costs on an economy that may include unintended consequences such as damaging the environment or destruction of historic sites.

Environmental problems

Prof Gananath Obeysekere in a recent article the sugar project has claimed that the Uva Wellasa region where the new sugar project is proposed will be “raped”. He says that the “area is studded with archeological remains, such as Brahmi inscriptions, drip ledge caves where monks meditated and more developed meditational complexes, ruined viharas and Buddha statues”.

Elephants are attracted to certain crops and have a particular fondness for sugarcane. The project will almost double the area under cultivation of sugarcane probably with a multiplier effect on the elephant problem.

Dr. Sumith Pilapitiya onetime leading environmental specialist for South Asia in the World Bank and the former Director General Wildlife maintains that the Pelawatta and Sevanagala sugar projects have encroached into prime elephant habitat and are a source of the human-elephant conflict. Thus protecting an uneconomic local industry at a huge cost to consumers is also harming the environment. If the tax on sugar was rationalised, with local sugar taxed at the same rate as imported sugar the distorted incentive to expand the industry would disappear, solving the associated environmental problems with it.